My Scalping Vs Swinging Strategies for Leverage Trading

There are many different trading strategies out there. Everyone has their own way of doing things and you will have to find your own method as well if you plan on becoming a professional trader. Having a game plan is key when going into any kind of trade, so it’s wise to plan ahead and know what type of trade you are looking at.

One of the first things you need to figure out is if you are going for a scalp trade or a swing trade. For me, this is going to let me know what kind of time frame I am looking at and also the amount of leverage I am going to be using for the trade. Let’s talk about the differences in the trading styles and how to look for each type. Later I will also show a couple of chart examples.

What Is The Difference Between Scalping and Swinging

A scalp trade is a quick in-and-out trade that you look for on the lower term time frames. Scalping is generally done using the lower 1m – 30m time frames. This is when traders look to make profits on short-term moves in the markets. Most scalp traders play big bets on these moves and smart traders play tight stop loss and take profit percentages. When leverage trading, this is when I use higher leverage like 30x-50x leverage.

Swinging, and no I don’t mean that kind of ‘swinging’ LOL, is when a trader is looking to go on a longer-term journey for profits. Swing trades are usually managed on the higher term time frames like the 1HR-1D time frames. In traditional markets, even the 1 Week time frame is used. In leverage trading, this is when I generally use a lower leverage like 5x-10x leverage.

When To Look For Scalps Vs Swings

When I start my day and get into the charts, I first start on the higher time frames. I start at the 1 Day time frame and start working down to the 4HR, 2HR, and 1HR time frames. Looking at these higher time frames lets me know what the markets are doing on a bigger scale. If I see something on those timeframes that looks like a larger market turn, I will look to playing a longer swing trade and try to take advantage of the bigger moves for bigger gains, using lower leverage.

If markets are in a ranging zone, meaning that on a longer term time frame, the price action is consolidating and just bouncing back and forth in a particular range, then I am looking to scalp trade. This is when I move into the lower time frames like the 5m, 15m, and 30m time frames. This is a much more active style of trading and pretty much requires you to be in the charts while your trade is happening, that is unless you set proper stop loss and take profit marks and just let it ride. Many scalpers don’t even set SL/TP levels and just trade ‘free handed’. This means that they are hitting the market buy and sell button when they are making their moves.

Chart Examples

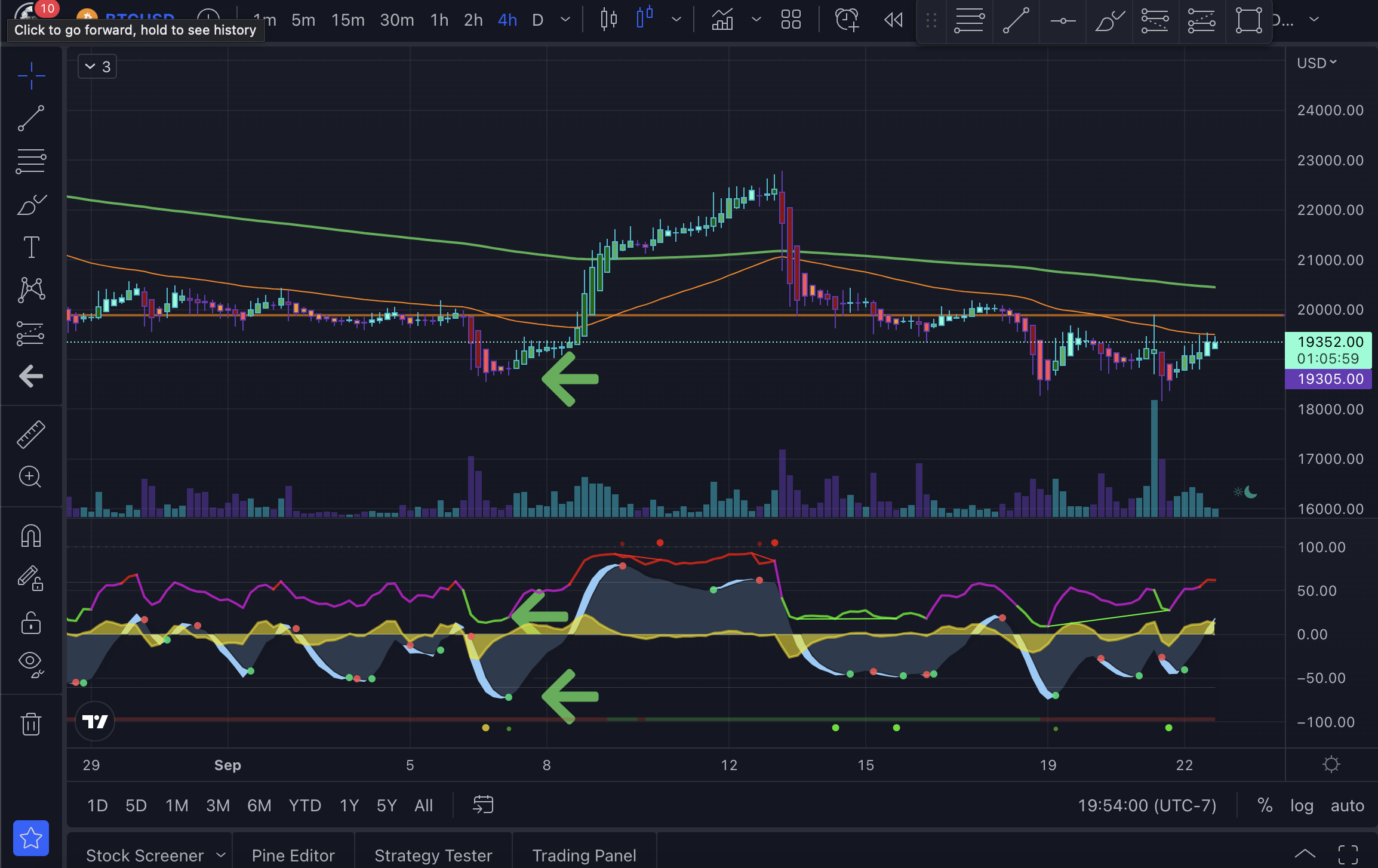

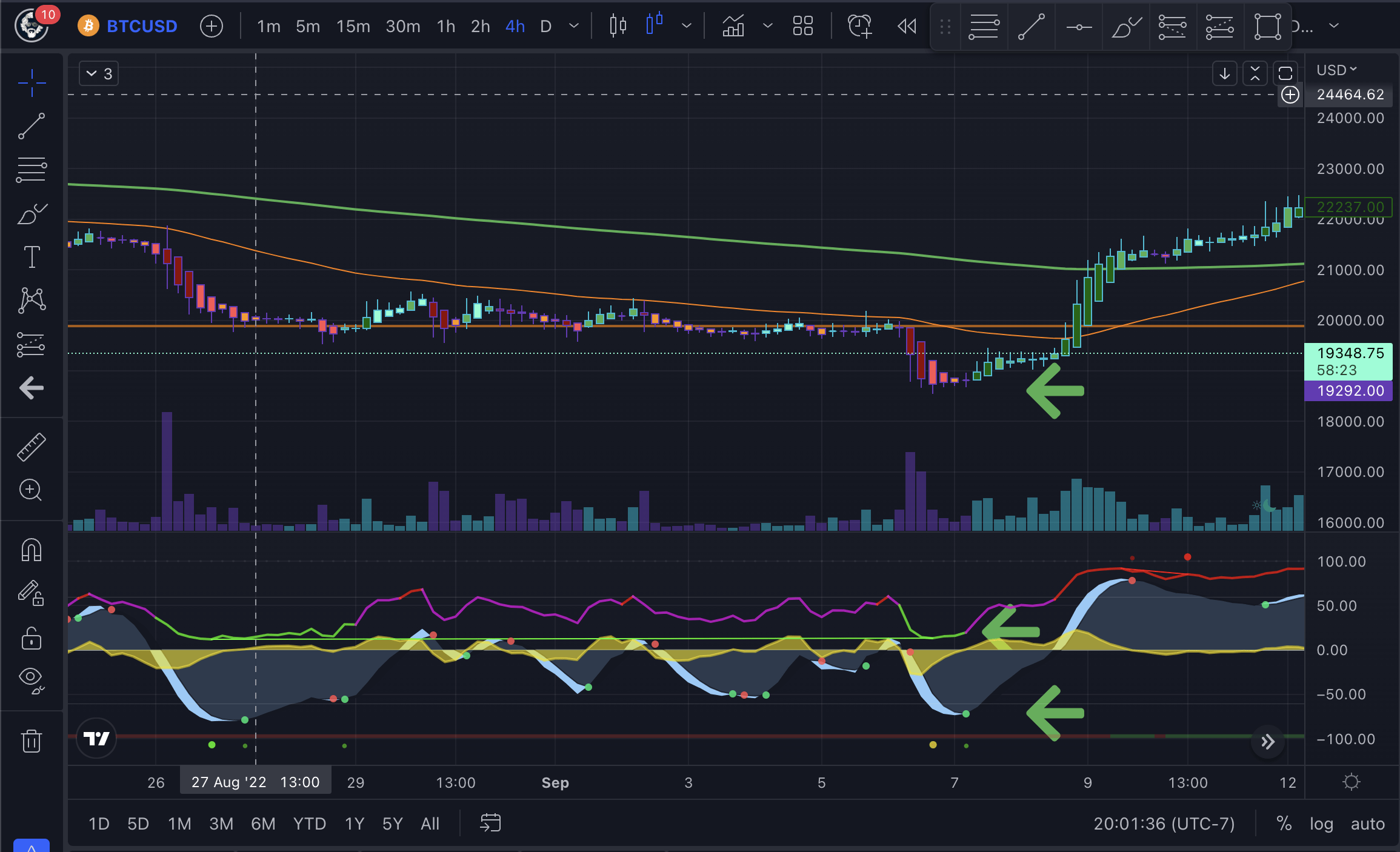

In this chart example, we are looking at BTC on the 4HR time frame. When I am looking at a swing trade opportunity, I am looking for the momentum wave, or the MACD, to be hitting a bottom point and showing a buy signal. I am also looking at the RSI, and looking for it to be oversold, as in the example above. Then I am looking at price action and volume and looking for a change in trend.

In this example, where we see the green arrows, was a great time to take a swing trade because it took a bit more than 5 days to top out. This is the time where you take a lower leverage trade and you can have a wider stop loss and take profit set to give the price some room to move. This is when I am doing a 1:3 or 1:4 SL:TP ratio.

If we look at this section of the chart, you will see the price range before that bigger move is made. On a longer-term trade, this is boring, so these are the times that the time to get down and dirty into the lower time frames. I look at scalping like a video game, lol.

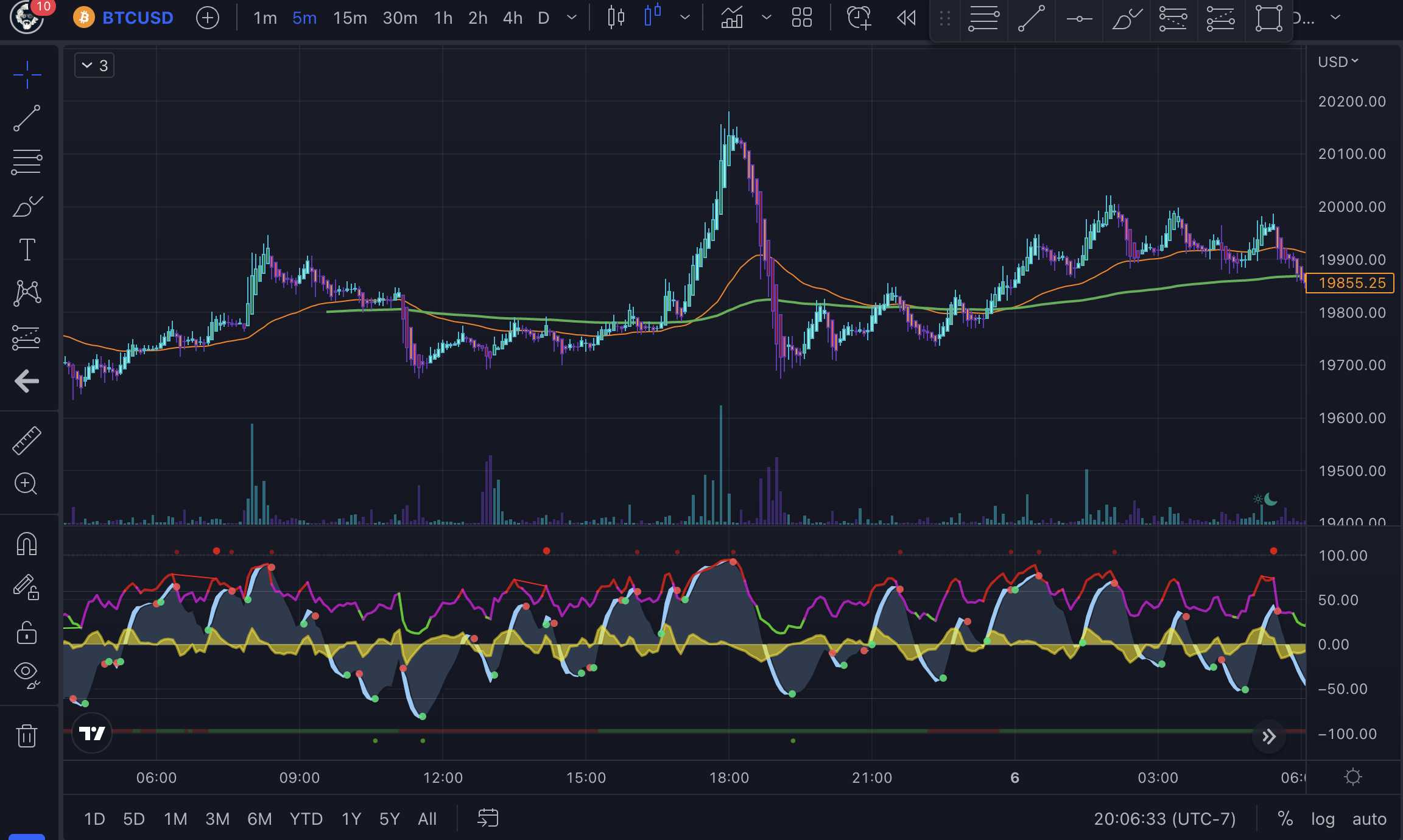

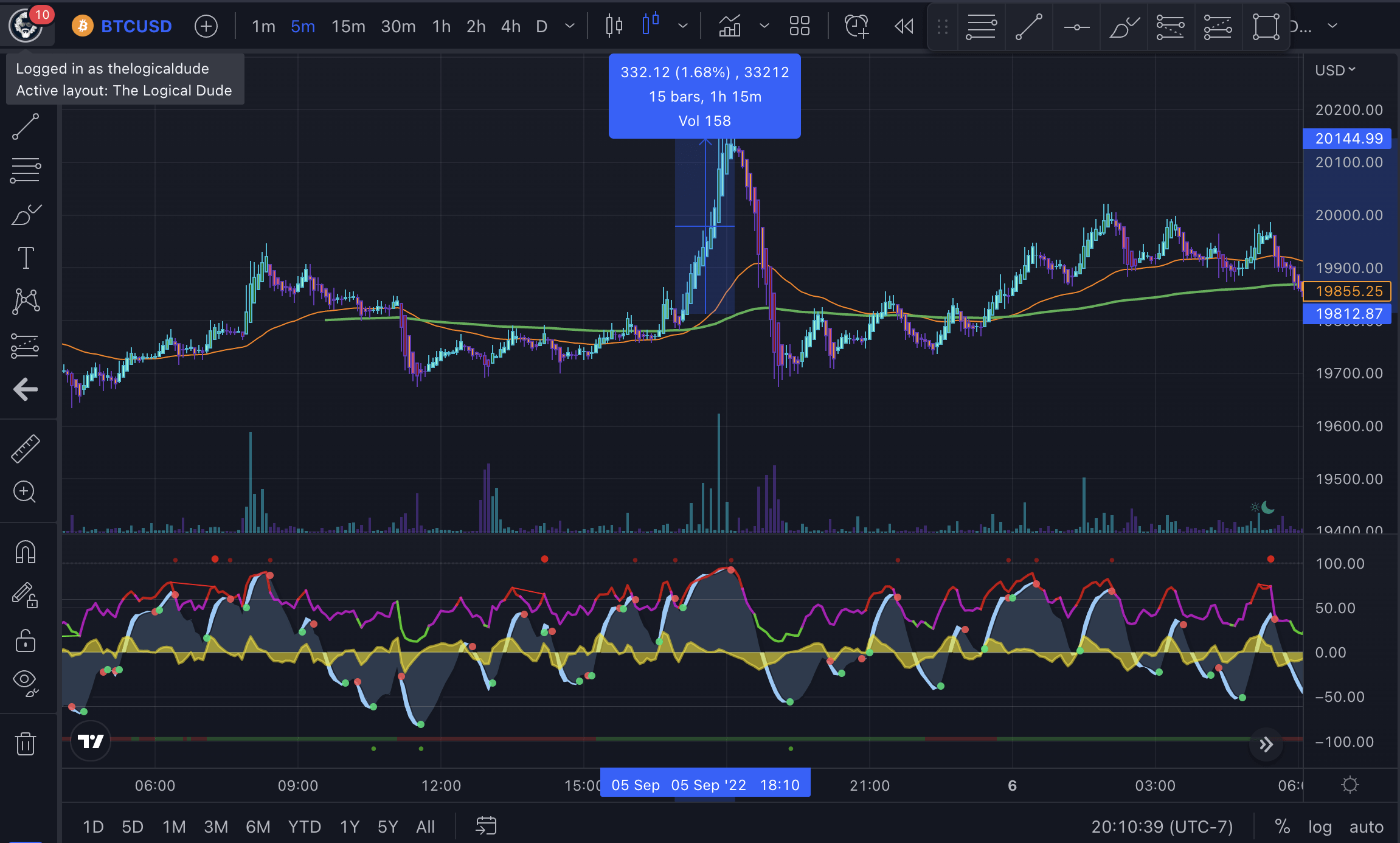

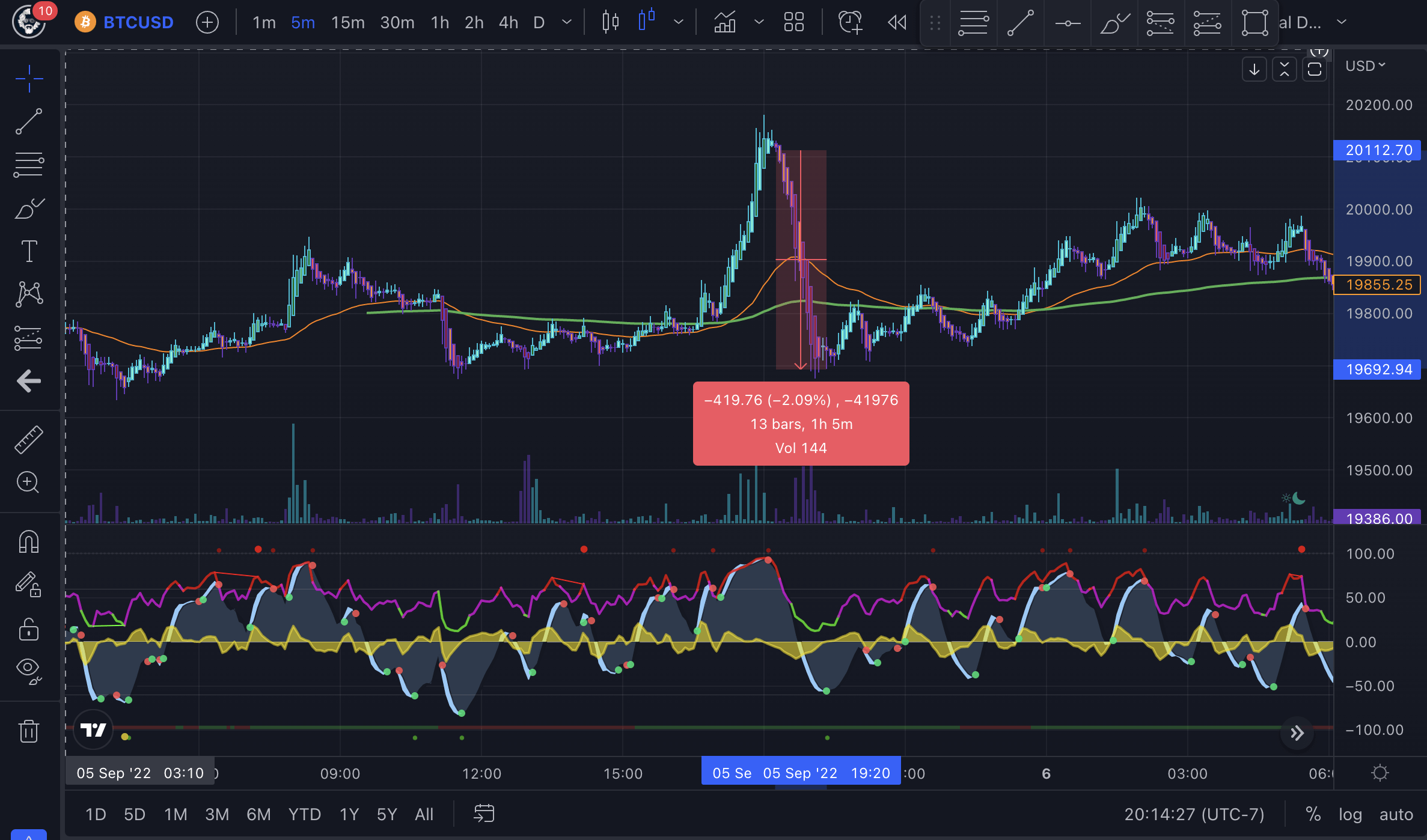

This is the section of the chart just to the left of the green arrows above, but on the 5 minute time frame. You can see here, that when it’s boring looking on the longer term time frames, there is a lot of action to play on the lower term time frames. This is the art of scalping.

Scalp trades can go as long as a minute or two up to about an hour of time. In this example, if you would have taken this trade, you would have made 1.68% in just 1 hour and 15 minutes. When you make this trade at 50x leverage, well that’s more like 84%. You can see the power of using leverage in a short trade like this.

You could have then turned right around at the sell signal and caught the short trade that lasted for 1 hour and 5 minutes at a 2% gain, at 50x, that’s 100%!

This shows the power of playing the lower time frames with higher leverage! I am one that plays scalp trades pretty tight. I will generally only set a stop loss, of something like .3-.5%. I like to manage my take profits as I go. I have set preset take profit levels in the past, then they don’t hit and the trade ends up going another way, not cool. I only set take profits when I am stepping away from the trade while it is running. But usually when I am scalp trading, I am in the charts, in the moment, watching the action and ready to take my profits. Again, I look at scalping like a money making video game.

Scalping and Swinging At The Same Time

There may be times that having both a longer swing trade and running some scalps can be a good way to go. This gives you the best of both worlds. You can play the longer-term move and make those bigger swings, and while that is happening, you can play the lower-term time frames with a different part of your account, and try to make those quick gains.

But of course, everyone will have to play with their own method of trading and find what is best for them. Trading is difficult, no doubt about it, and it takes a lot of education and patience to make money in these markets. It can be an extremely fulfilling venture, as long as you take the time to invest in yourself. Start our just ‘chart trading’ or ‘paper trading’, so that way you can hone in on your strategies while not risking any money. But, no matter how much you plan, you will lose money at some point, the idea is to make more than you lose!

Take your time learning and be patient with yourself. I am saying this to myself as I write it, haha. Hopefully these articles will help you on your trading jouney!

Until next time…

Be Cool, Be Real, and always ABIDE!

Nothing said is financial advise.

This is for educational and recreational purposes only!

Stay safe in these volatile markets and don’t get rekt!

Follow the markets and get the latest data and news on Coin Logic

Trade with me on Apollo X on BSC