Being In Cash Is Always A Trading Position – Looking At The DXY

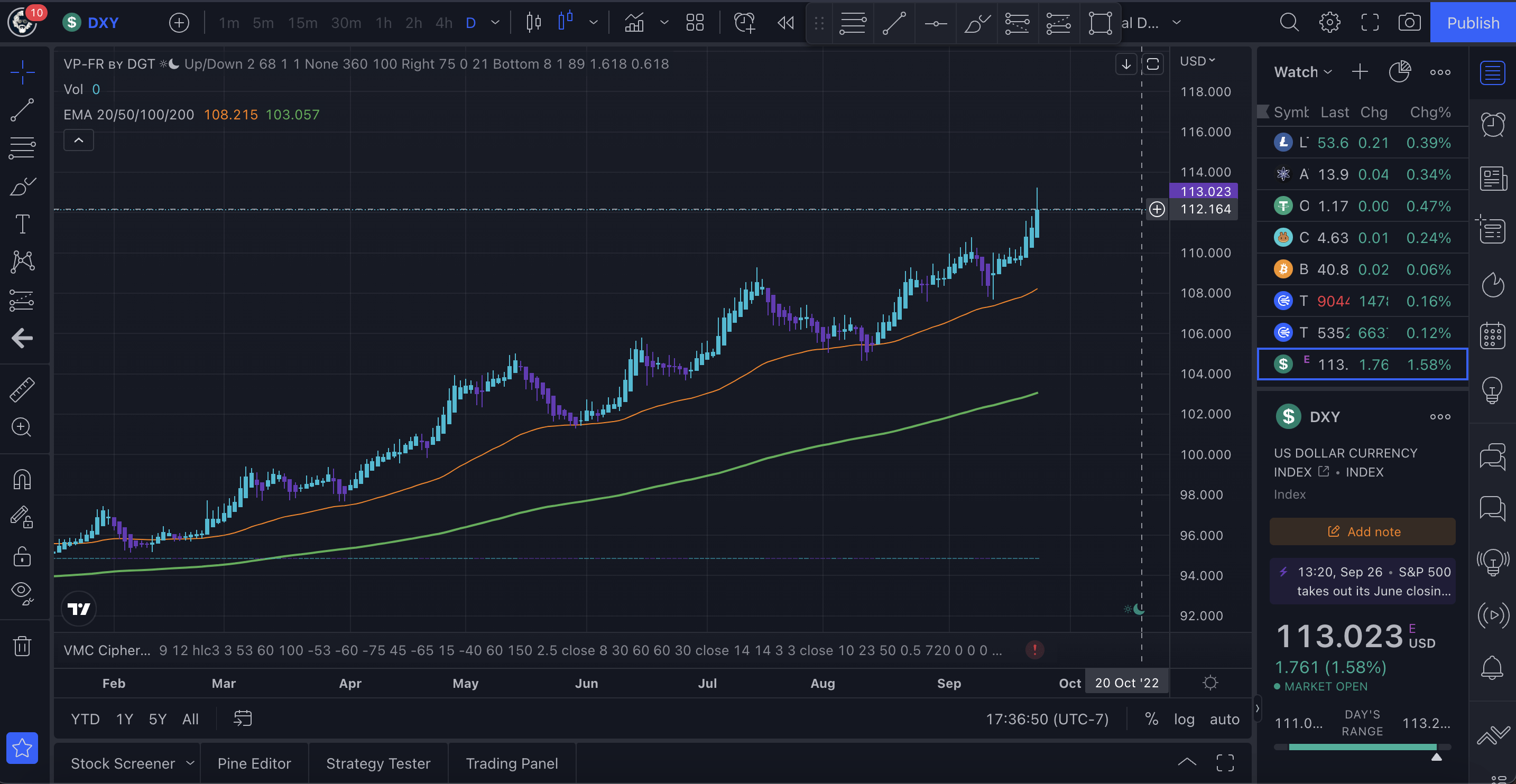

The US Dollar has been on a run and has hit its highest levels since May 2002 and before that was in 1985. So needless to say, we are in some unprecedented times. Now I do not claim to be an economist, I am just a dude that has been studying the crypto space with some traditional market experience for the last 4 years or so, so nothing said here is financial advice, just my opinion.

Why Is This Happening?

Well, again, not an economist, but it seems that people are flocking into the dollar as a safe haven asset to cover themselves in what could be possibly dark times ahead. When the DXY, or the US Dollar Currency Index, is high, generally other assets like stocks and commodities are in the gutter. But at the same time, the cost of food and energy are at all time highs. So really, what is the dollar worth? For me, it’s a transfer of energy from one form to another. I do not want dollars, and honestly, my faith in crypto has been wavering a bit. I am still strong on Monero, and Hive, but other ecosystems are really starting to make me nervous, including Bitcoin.

Looking All The Way Back

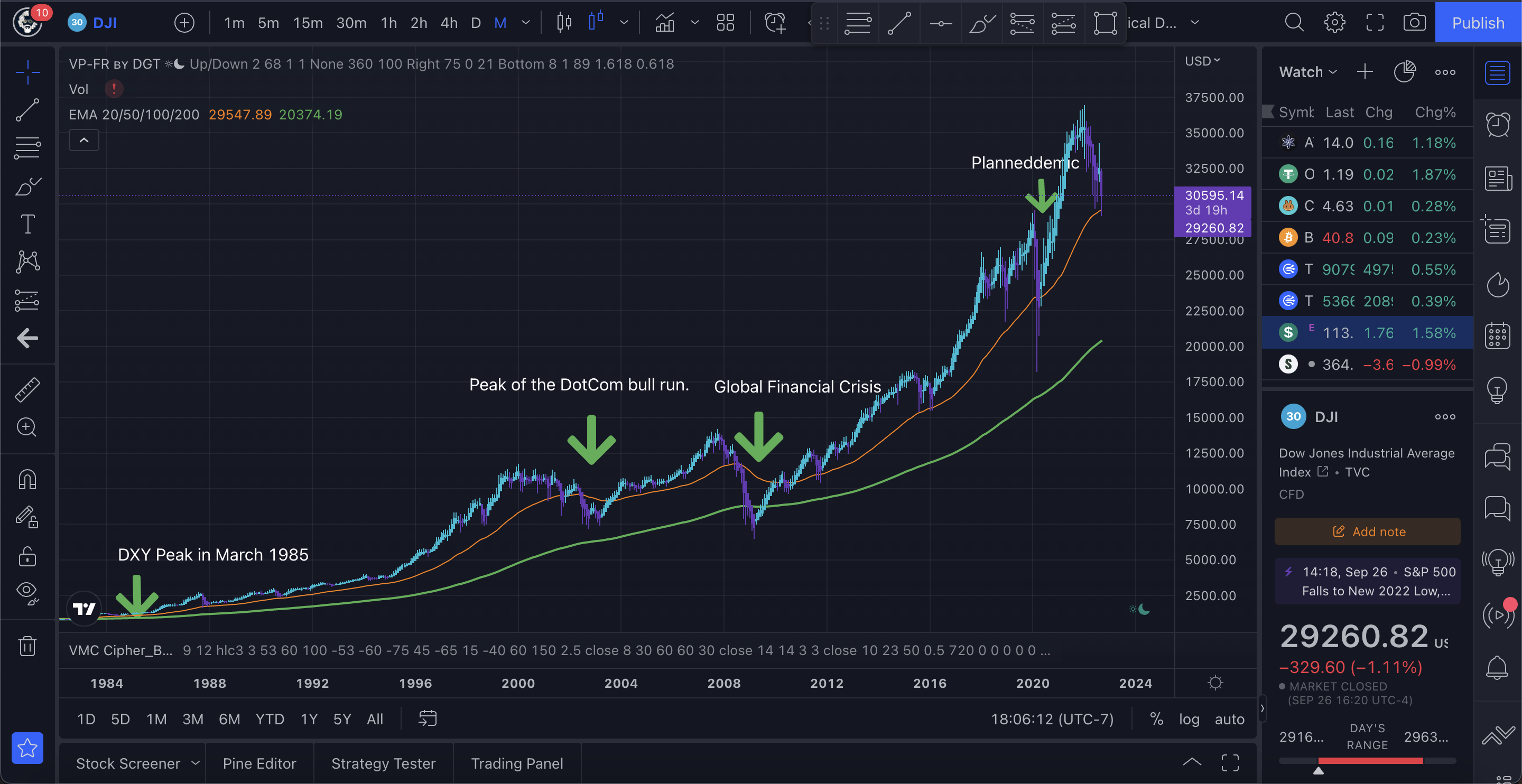

This is the DXY going all the way back to its beginnings in the 1960s. You can see it’s peak in March of 1985, which was a few months after a large correction in the markets. Same with 2001 and 2002, but not as sharp of a peak. It actually accumulated for longer than the run in the 80’s. In the 80’s, by the time the DXY peaked, the Dow Jones Industrial average was in a consolidation period and was starting to climb into what became the biggest stock market bull run in history, at that time, and didn’t stop until the DotCom crash of 2001-2002. As the DOW ran, the DXY fell, and fell hard.

This is the DJI, or Dow Jones Industrial going back to the 1980s so you have a bit of a reference. The only time that the DXY and the DJI were not inversely correlated, meaning they were not polar opposites of each other’s moves was in the 2008-2009 Global Financial Crisis, which was when all the money printing started.

As the stock market rallied for the biggest bull run in history, we have seen the value of the dollar grossly under perform. These are times that of course you want to be holding appreciating assets like stocks or crypto. But in times like we are in now, which, let’s just face it, the worst economical times I have seen in my lifetime, we are seeing the DXY run up to levels it hasn’t seen in 20 years.

Is This A Flight To Safety Or Last Ditch Effort?

Is this run of the DXY showing people flying to a safety net, which in my personal opinion, the dollar is not safe, or is this just inflation kicking in like it never has before in this country’s history? Honestly, I am not sure.

I ditch every dollar I get my hands on. Lately though, it has not been for crypto or stocks, but for food, batteries, bullets, and other tools and supplies I would need in really any kind of situation. Because I will ask you this now, will you be able to survive if they collapse the power grid? I want you to think real long and hard on that…

So as risk on assets like stocks and crypto are taking a beating, even commodities have been taking a hit, but yet somehow gas jumped back up and over $5 a gallon in some places and food has steadily continued to rise. So based on that fact, why would I want to hold the dollar or currently assets that are declining in price.

Being In Cash Is The Best Position Currently

Now, when I say cash, I mean dollars or equivalent. Personally I am stacking stablecoins in the form of HBD, and then bHBD-BUSD in Cubdefi. I am waiting on the full bottom to come in before I try to buy up any more volatile assets.

As far as trading is concerned, I have been looking at the downtrends, but at the same time, the last week or so has been hard to trade, so staying on the sidelines is sometimes the best play. If you are not trading, stick it into some liquid bHBD liquidity pools and earn some interest on it while you are waiting on the big turn around! At least, that is my current play. I have some sitting in my trading account, but the way things have been moving lately (which is not much at all), I am just earning some yield and biding my time.

Trade With The DXY

We are bound to see the DXY turn around at some point. And when it does, that will be some of the best times to go in and ride the next waves. Again, not financial advice. Personally, I am trading pretty much nothing but Bitcoin, so when that time comes, I will be going long with some leverage and making some money!

Now this may take some time, so it’s important, especially if you are trading against the USD, that you keep the DXY chart handy so you can watch for moves. It’s smart to play them as reversely correlated. When the dollar pumps, you don’t want to be in Bitcoin. When the dollar crashes, it’s BTC time baby!

Anyway, hope you get something out of all this. Be safe out there in these crazy markets!

Nothing said is financial advise.

This is for educational and recreational purposes only!

Stay safe in these volatile markets and don’t get rekt!

Follow the markets and get the latest data and news on Coin Logic

Trade with me on Apollo X on BSC