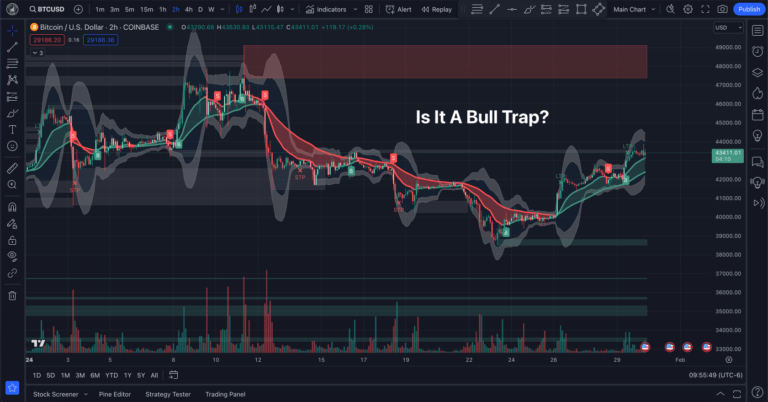

Are We Looking At A Bitcoin Bull Trap?

In my last TA post, I talked about the possibility of Bitcoin heading back to the $35-36 range before the halving, and I still don’t think I am wrong about that. Are we looking at a bitcoin bull trap? I…

In my last TA post, I talked about the possibility of Bitcoin heading back to the $35-36 range before the halving, and I still don’t think I am wrong about that. Are we looking at a bitcoin bull trap? I…

I don’t know about you all, but I am itching for some lower Bitcoin prices since this move has started. There is nothing that retail traders can do at this point to stop the downside in the Bitcoin price action…

Welcome, my lovely traders! Today, let’s chat about a common pitfall that many beginners stumble into on their trading journey – overtrading. It might sound like a harmless term, but trust me, it’s a sneaky beast that can wreak havoc…

Don’t you love it when a plan comes together? I had a killer short trade called by the Logical Trading Indicator on BTCUSD futures this morning and scored big on a small leverage trade. I am trying out the new…

Hey crypto traders, if you don’t know about the Bitcoin dominance chart and why it matters for all you traders out there, listen up! So, picture this: the BTC.D chart on the daily timeframe is throwing some serious signals at…

Doing some cycle analysis today and looking at the bigger trends. One thing I have been noticing is the correlation that Bitcoin has with last cycle’s action. To me, Bitcoin is on track with last cycle, sometimes you just have…

In the realm of trading and investments, there’s been a trend towards Exchange-Traded Funds (ETFs) for things like gold and silver, and now Bitcoin, because they are easier to use and aquire which is appealing to traditional investors because they…

In the dynamic world of trading, the notion that more trades equate to more profits is a very common misconception among beginners and intermediate traders. It’s easy to fall into the trap of believing that constantly being in the market…

The market, like the ocean, has its waves. These waves represent trends – the general direction in which an asset’s price is moving. Beginning traders often underestimate the power of these trends, either being sucked into the fear of missing…

Hey there, fellow traders! If you’re new to the exciting world of financial trading, you’ve probably come across various charting techniques and tools. One of these techniques that might have caught your eye is Heiken Ashi candlesticks. Fear not, because…