The Logical Market OutLook – Altcoins Are On The Run

Happy Monday everyone! Taking a look at the markets at the start of the week and I am seeing that the altcoins are making a bit of a run making way bigger moves than Bitcoin. Bitcoin dominance has been dropping which means more money is going into the the different altcoins. As you do have some outliers that kind of do their own thing, most of the altcoins tend to follow Ethereum during times like this, and that is why when alts are pumping, we are trading ETH/USDT perpetual pairs on ApolloX!

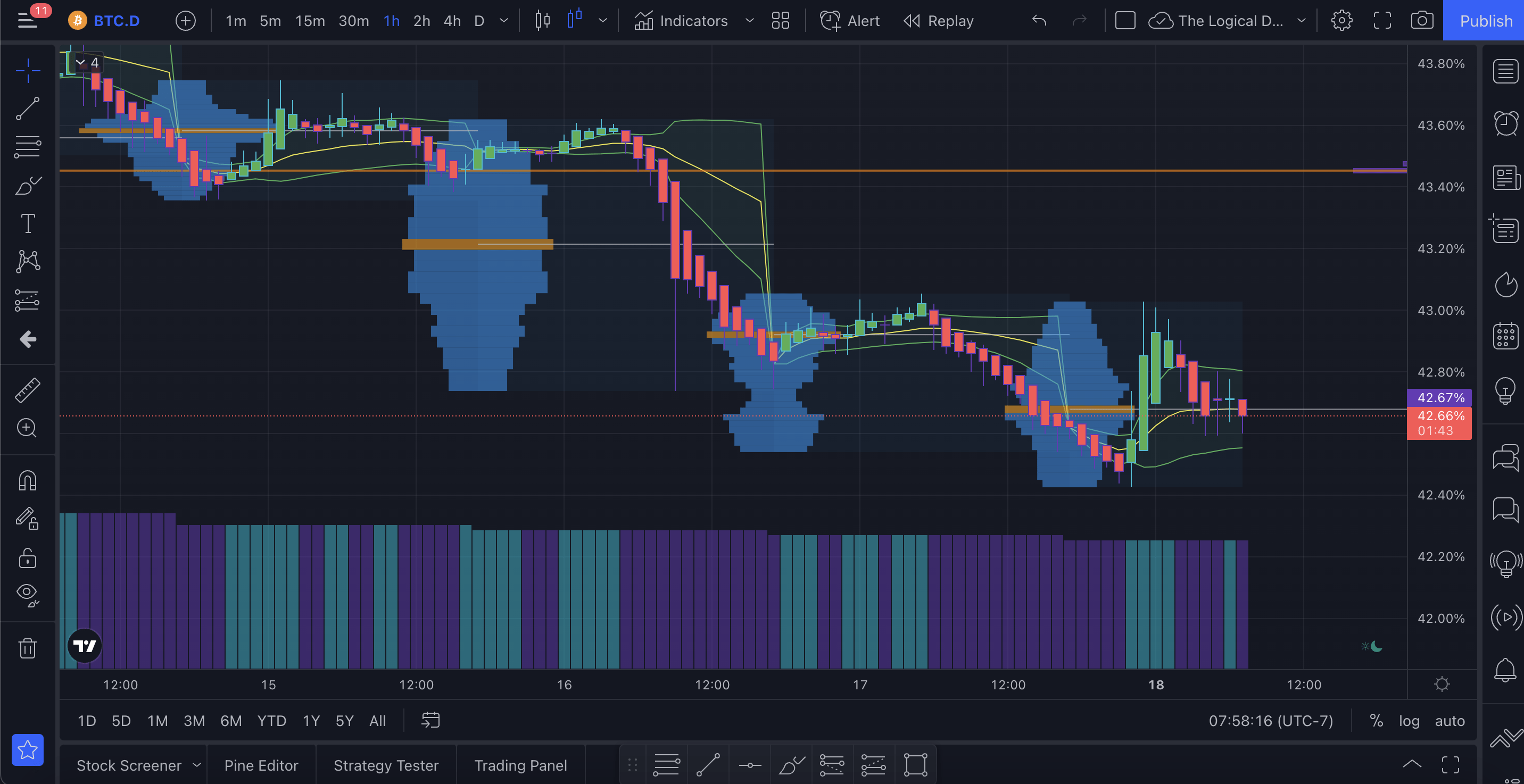

Dropping BTC Dominance

Taking a look at the BTC dominance chart and it’s clear that the altcoins are currently on a run. This is one of the charts that we look at when we start to judge how to trade for the day or the week. So by the looks of this, Bitcoin is probably going to be a bit slower to trade than Ethereum or some of the other altcoins. The BTC.D chart has been in a steady decline for the last week or so, dropping a bit here and there over time with some corrections here and there.

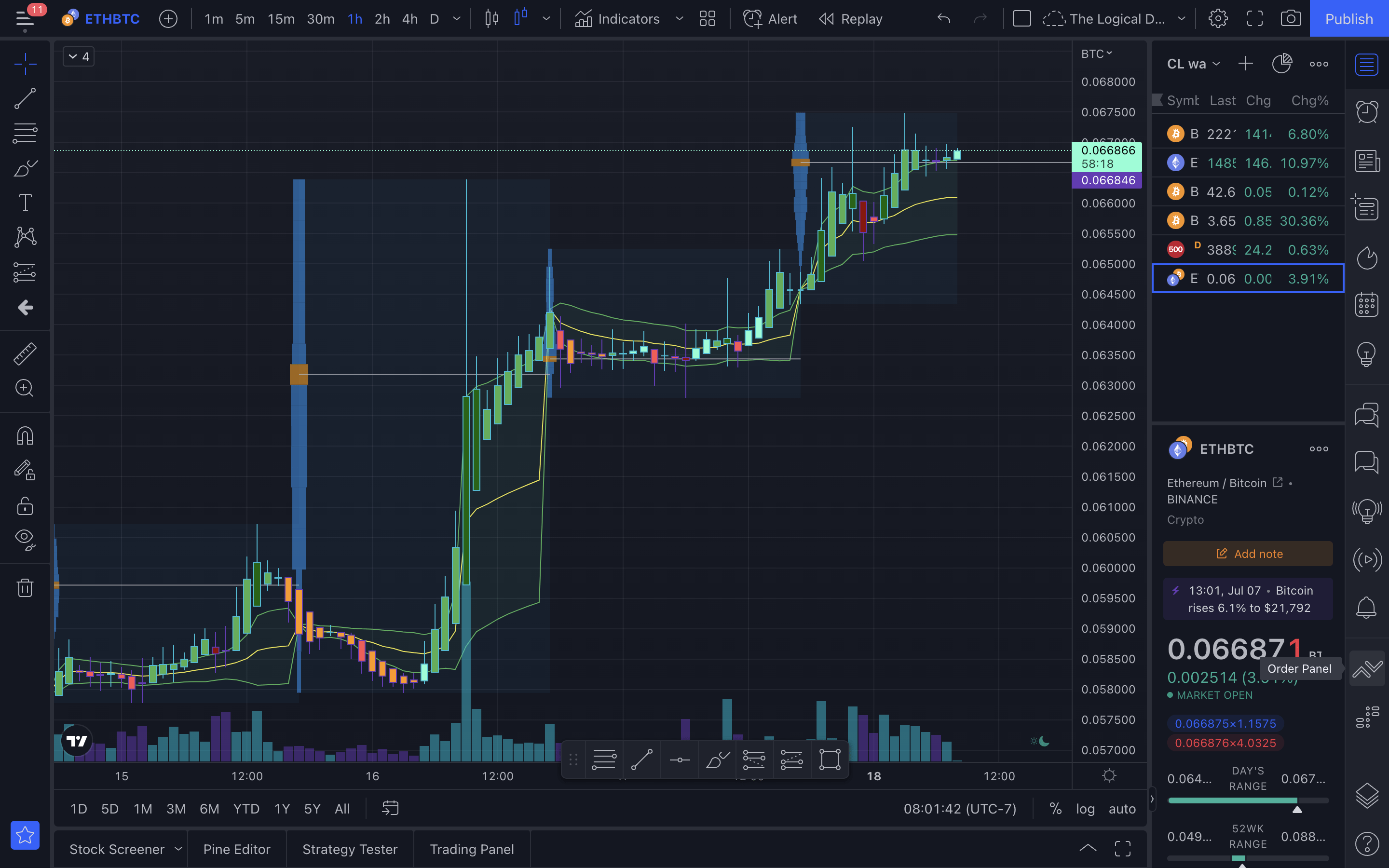

ETH vs BTC

Another chart to compare is the ETH/BTC chart. This chart lets you know how the price of ETH is doing against Bitcoin and gives you a good idea on which is the better trade at the moment. When the charts are looking like this, you are doing to do allot better day trading Ethereum or other blue chip altcoins vs Bitcoin which is generally just ranging and consolidating during these times. ETH is clearly the dominant one in this chart at the current time.

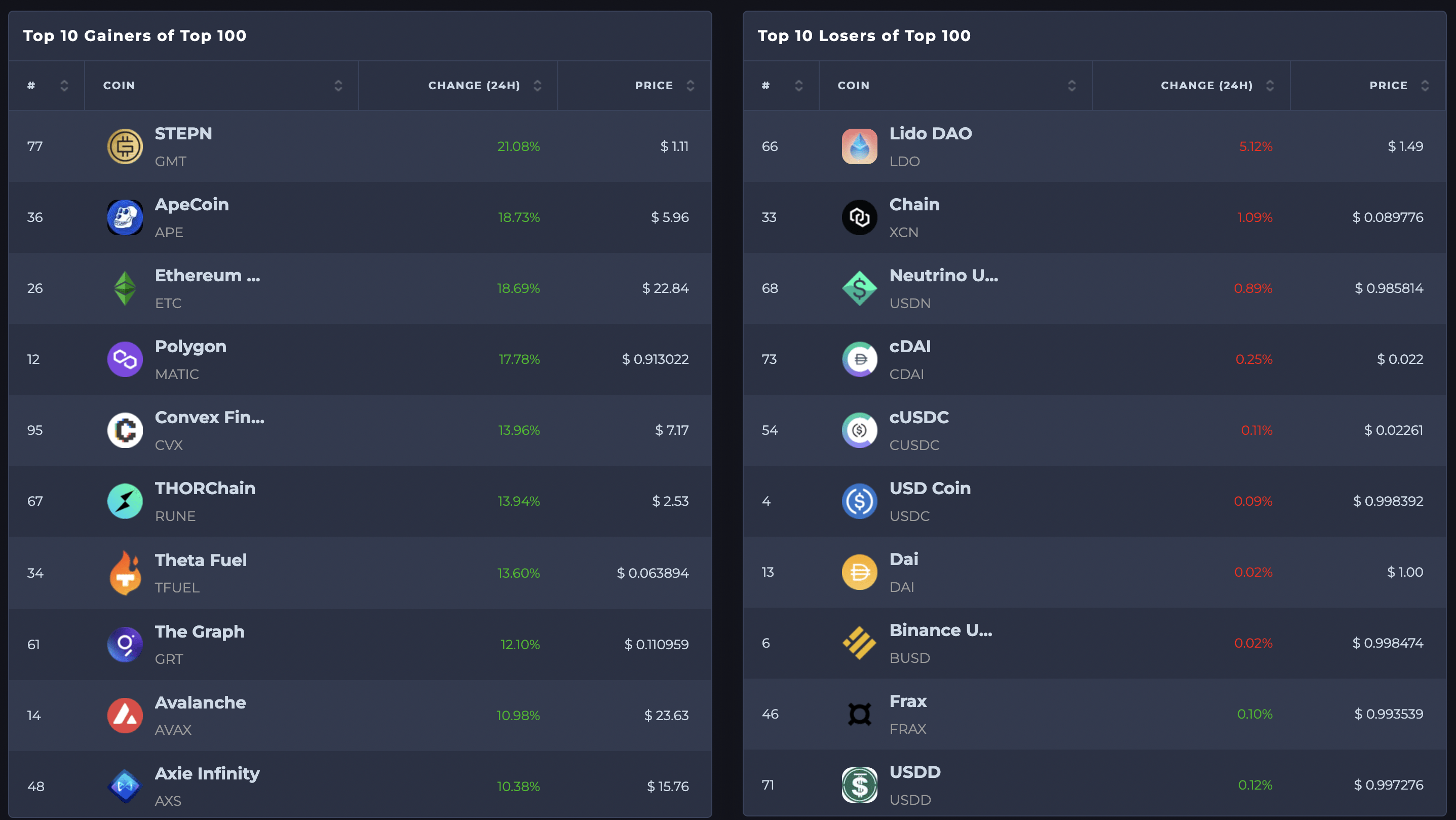

Trending Market

Taking a look at the Coin Logic Trending tab, we are seeing that many of the altcoins are doing quite well over the last 24 hours with way more green than red in the markets. This is also another sign that we are looking at a possible altcoin week, but it’s just Monday, we have to take these things day by day.

Having the green in the markets is making us look to bullish trend directions, but we have to take all the data into account! This weekend pump, may be topping out a bit on this run, so we are going to have to start watching for some reversals.

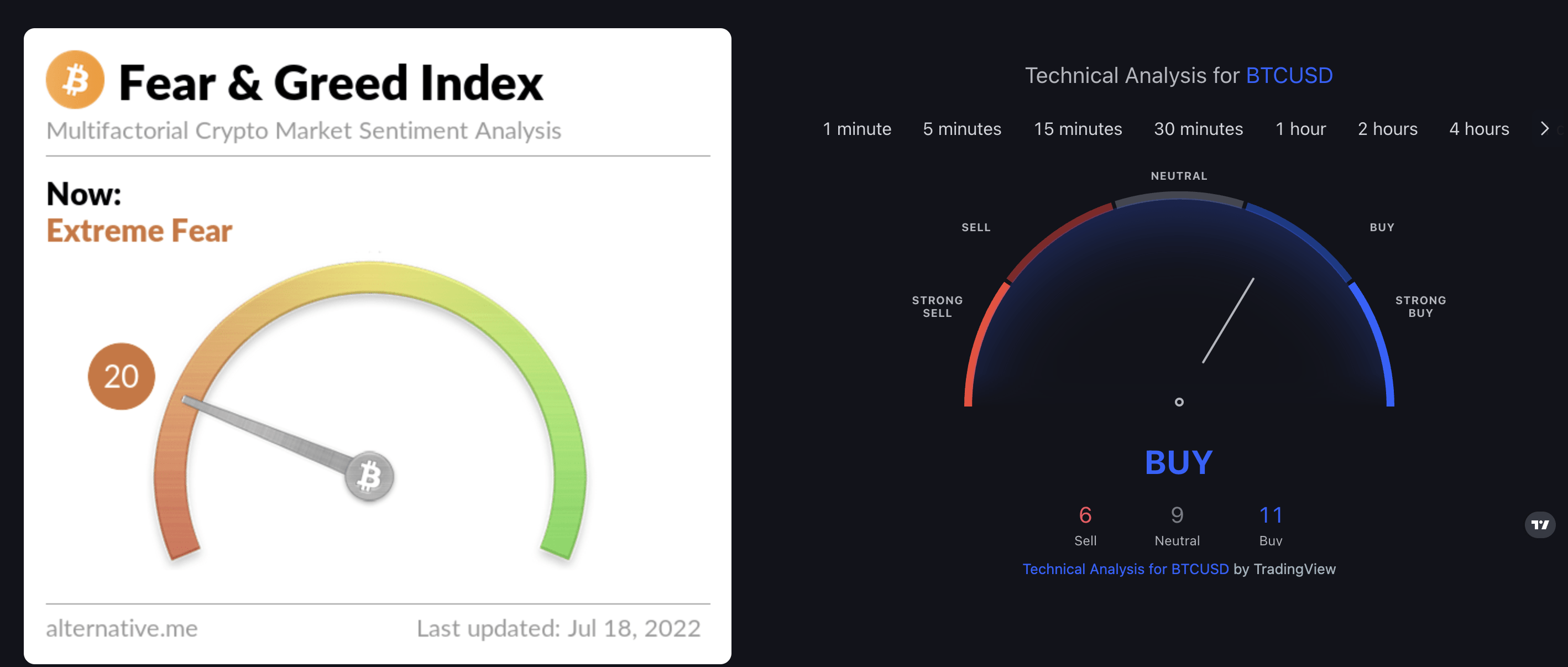

Although the TradingView technical analysis for Bitcoin is saying it’s a buy, the market sentiment is still at a 20 which is still in that Extreme Fear category. This means that people are still incredibly skeptical and scared.

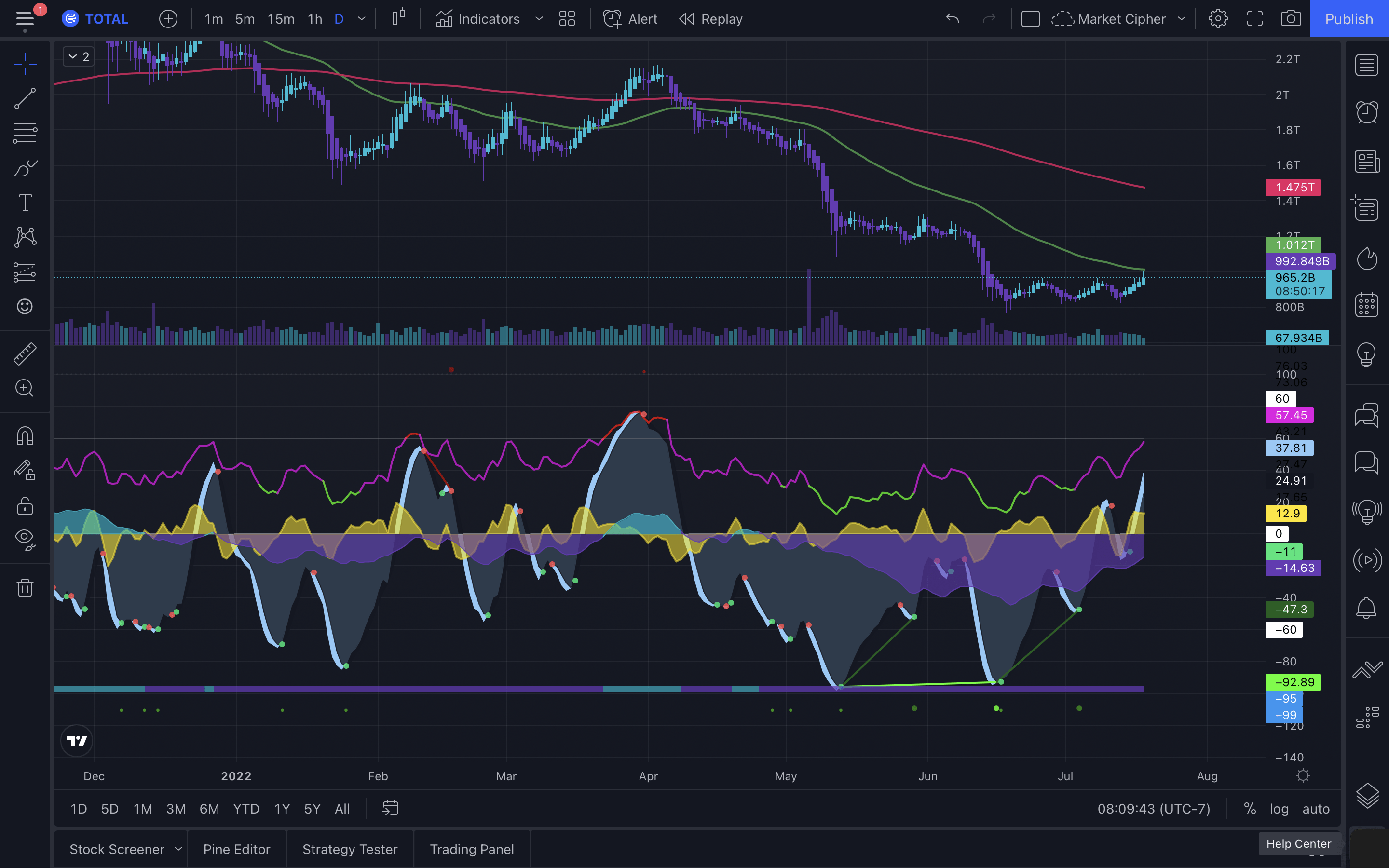

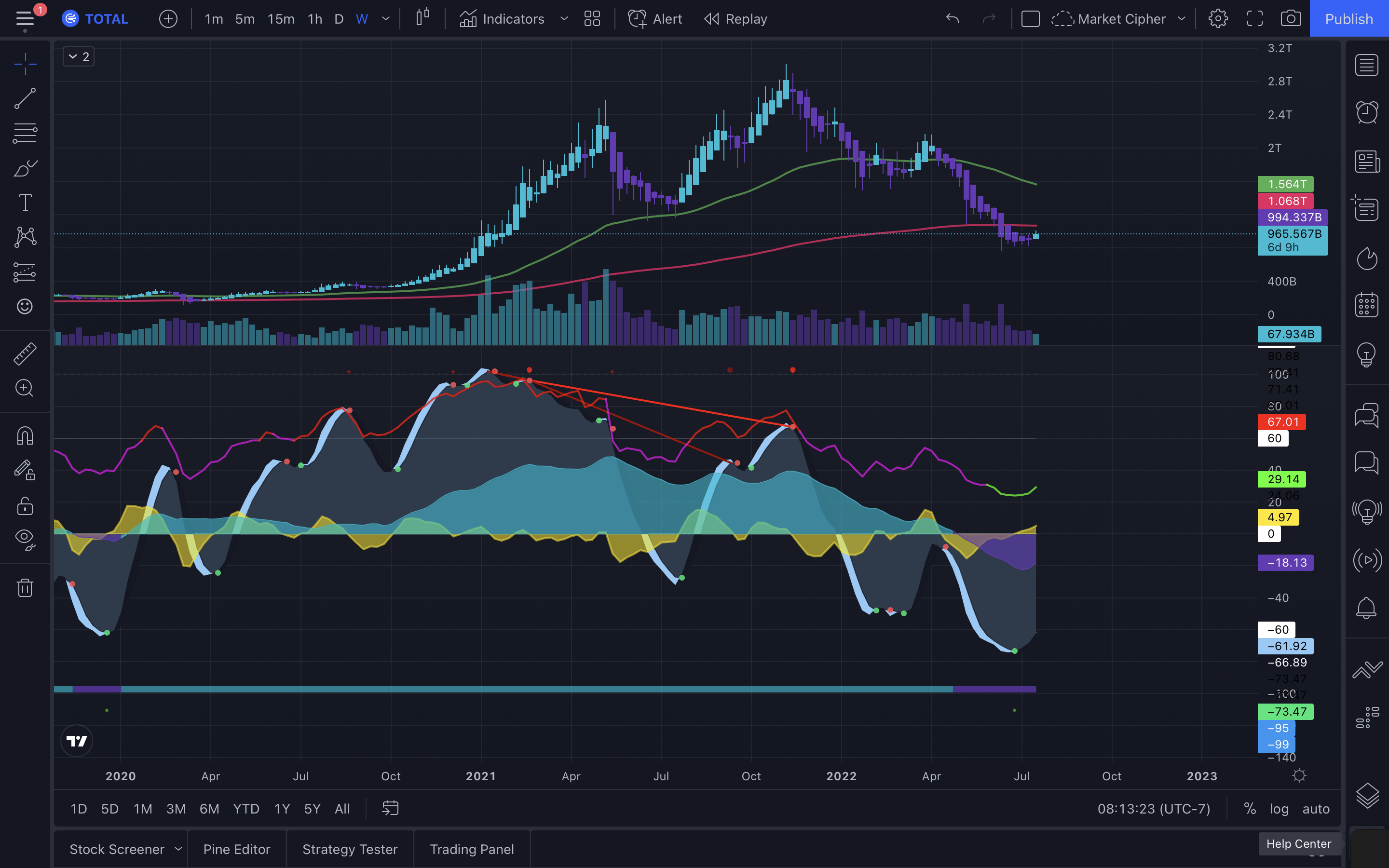

Total Crypto Market Chart

Many of us in crypto get so laser focused on smaller time frames and particular assets that we fail to step back and get a big picture view. Taking a look at the Daily time frame on the TOTAL crypto market chart, you can see that we are still in a downtrend and in a bit of a consolidation range. The Market cipher indicator is showing that the momentum is getting hot, but we still need way more volume coming into the market to be able to make a big push out of anything. Volume and momentum are looking a bit weak, but indicators are trying to move to the bullish side of the 0 line!

Zooming out to the weekly timeframe, it looks like the markets have found a bit of a bottom and are having a bit of a bounce, at least for now. The concerning factor still is that on this time frame we are starting to see the curve around of the 50 and 200 period moving averages to the downside.

This trend has been going for some time, but the direction is not looking great. If we end up with a death cross on these moving averages, that can spell some serious trouble for the markets, so this is something we are watching closely. Although the RSI is in serious oversold territory, that’s not to say we can’t have a small relieve rally then a dump back down. Many people say the downside is not over, but all we can do is just take the data as it comes.

What We Are Doing

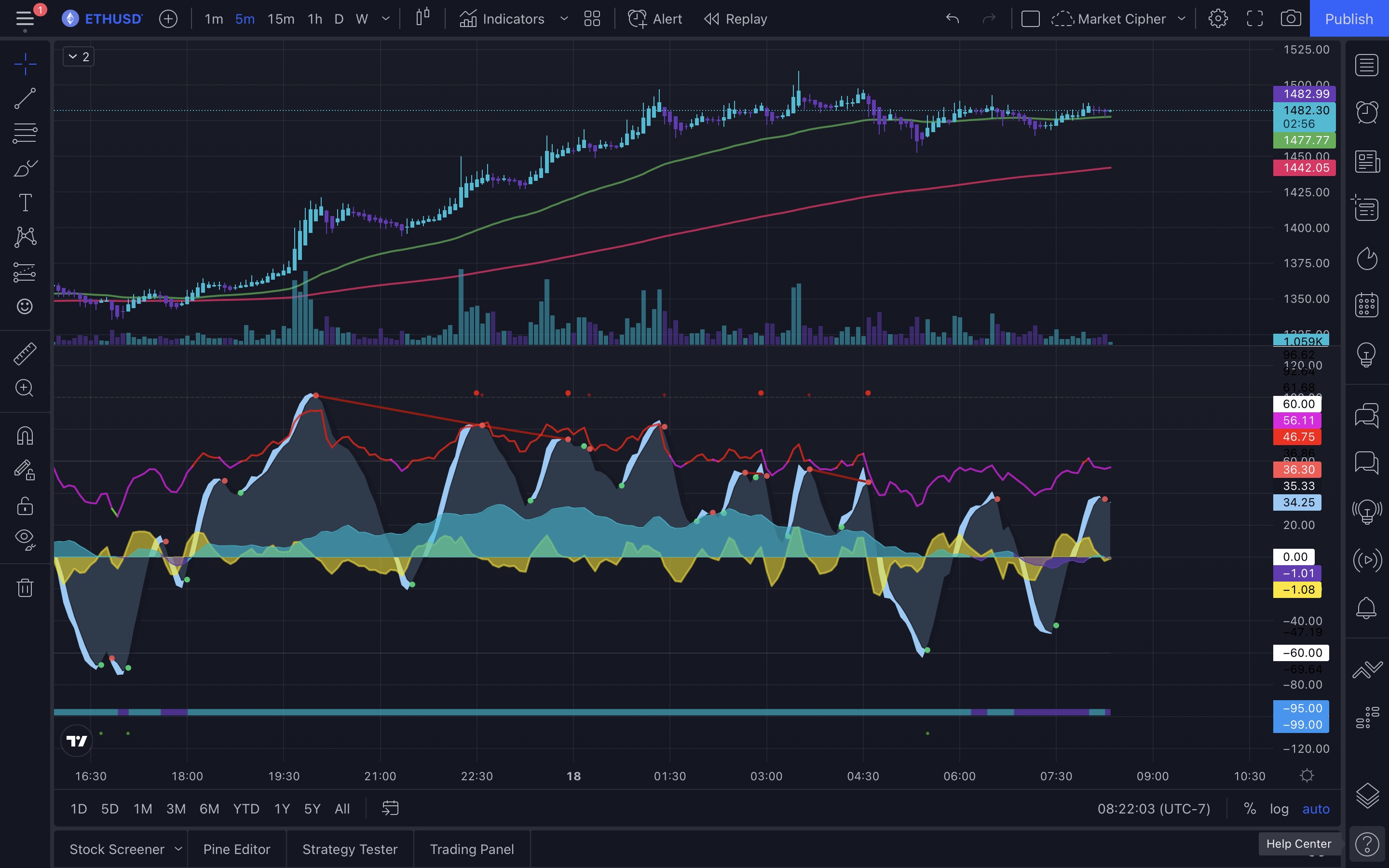

This week at the Coin Logic trading desk, we are looking at trading mostly ETH on the intraday time frames. As far as the near term trend, we are looking at this weekend pump possibly topping out and looking for some possible downside action.

Zooming on into the 5 minute time frame, where most of our action happens, we are looking at declining, yet consolidating momentum. It looks like the price hasn’t been able to get back to the recent high and is looking like it may be looking down hill. The 50 and 200 period moving average are still technically in a golden cross for the timeframe, but are starting to level out a bit. Our rule is when the 50 is over the 200, we are looking at long trades, when it is below the 200, which is a death cross, we are looking at short trades.

Right now, we are in waiting and assessing mode. We are looking for a large volume pump either way.

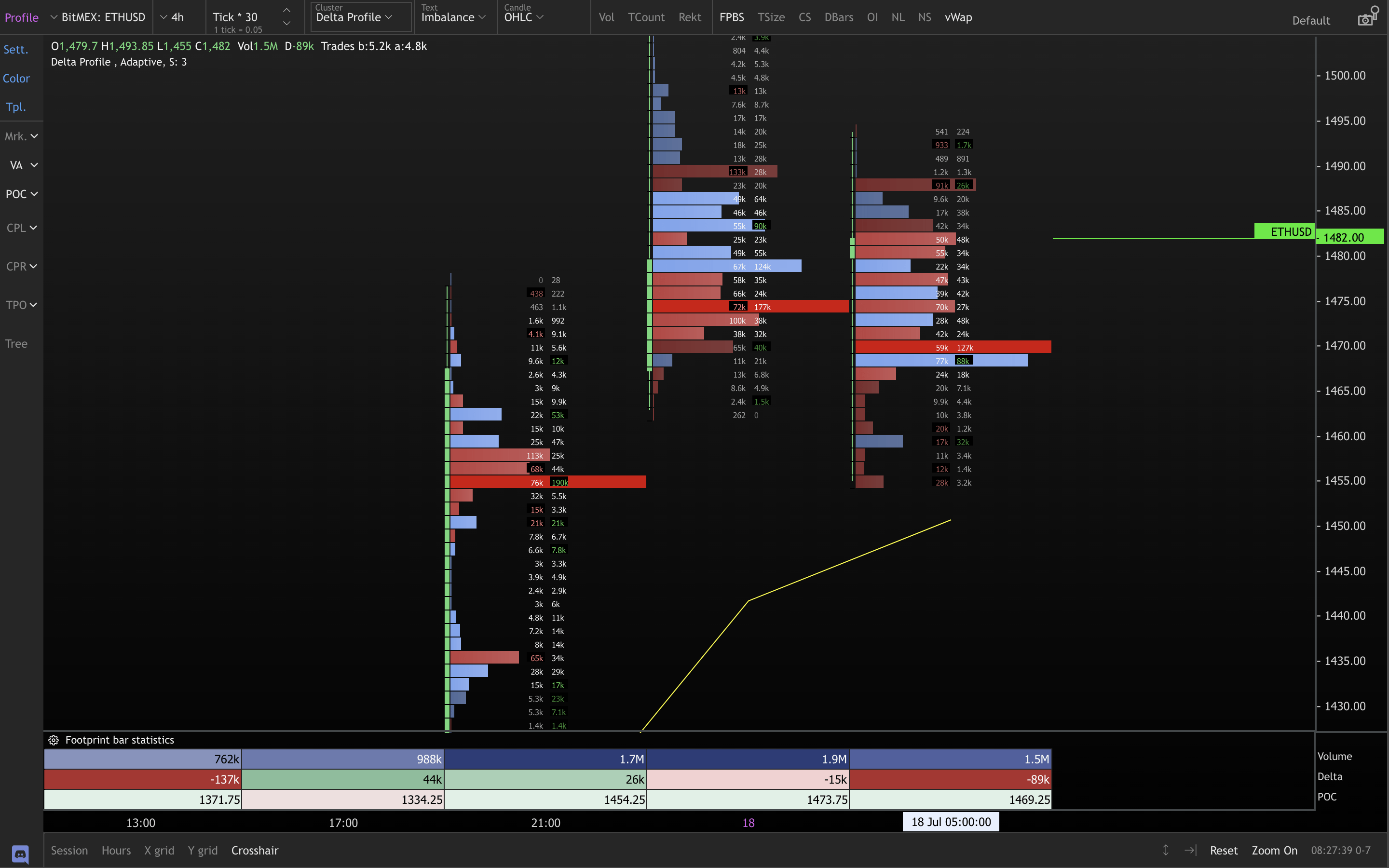

Looking at the 4hr order flow footprint chart for ETH on Bitmex, you can see that there is some room for a possible correction back down to the VWAP which is the yellow line. This would also bring price back down to those other points of control from the previous candles which shows strong demand for those price levels. There is also very heavy negative delta levels which indicates more sellers than buyers in this particular 4 hr candle. This could be signs of a reversal.

Name Of The Game – DYOR

Don’t just listen to me, or any other people out there, you want to make sure you are doing your own research. We are wrong, allot, but somehow we are making it out on the profit side and trying to improve with every loss. This is because we are spending the time to do our research on the charts and seeing how we messed up and how we can better improve the way we look at the data.

By bringing in different chart styles, this has really helped with understanding how the markets ebb and flow, but it is never perfect. Trading, especially crypto, is one of those ventures that will never get old. There is always something to learn and improve on. It’s an ever changing industry where it is you vs the market, but the only person you have to impress is yourself!

Here at the Coin Logic trading desk, which I like to make sound fancy, but it’s just me doing most of the trading, but also training my son how to read the charts and he has been doing pretty good about being able to spot some good trades himself. So he is helping with some of the research these days. One day we can turn into a full on trading firm, but hey gotta crawl before you can walk and you have to walk before you can run!

Be safe out there traders and until next time…

Be Cool, Be Real, and always Abide!

Nothing said is financial advise.

This is for educational and recreational purposes only!

Stay safe in these volatile markets and don’t get rekt!

Stake with our Cosmos ecosystem validator, carbonZERO

https://coin-logic.com/staking

Trade with me on Apollo X on BSC

Follow us on HiveHustlers.io and LeoFinance.io, both on the Hive Blockchain:

https://hivehustlers.io/@coinlogic.online

https://leofinance.io/@coinlogic.online

As well as on Twitter at https://twitter.com/coinlogiconline

Now posting to Odysee https://odysee.com/@coinlogictv

Videos by @thelogicaldude are posted to 3Speak through his account and posted to the Coin Logic TV channel on Youtube.