Planning A Week Of Bitcoin Trading

Waking up to make it to the opening bell of the NYSE and watching how the markets are reacting to Bitcoin’s price action from the weekend. Overnight, Bitcoin decided to make a move to the downside on short term time frames, crossing under the 50 period moving average, and on really short time frames, even below the 200 period moving average. So let’s take a look a head an start planning a week of Bitcoin trading!

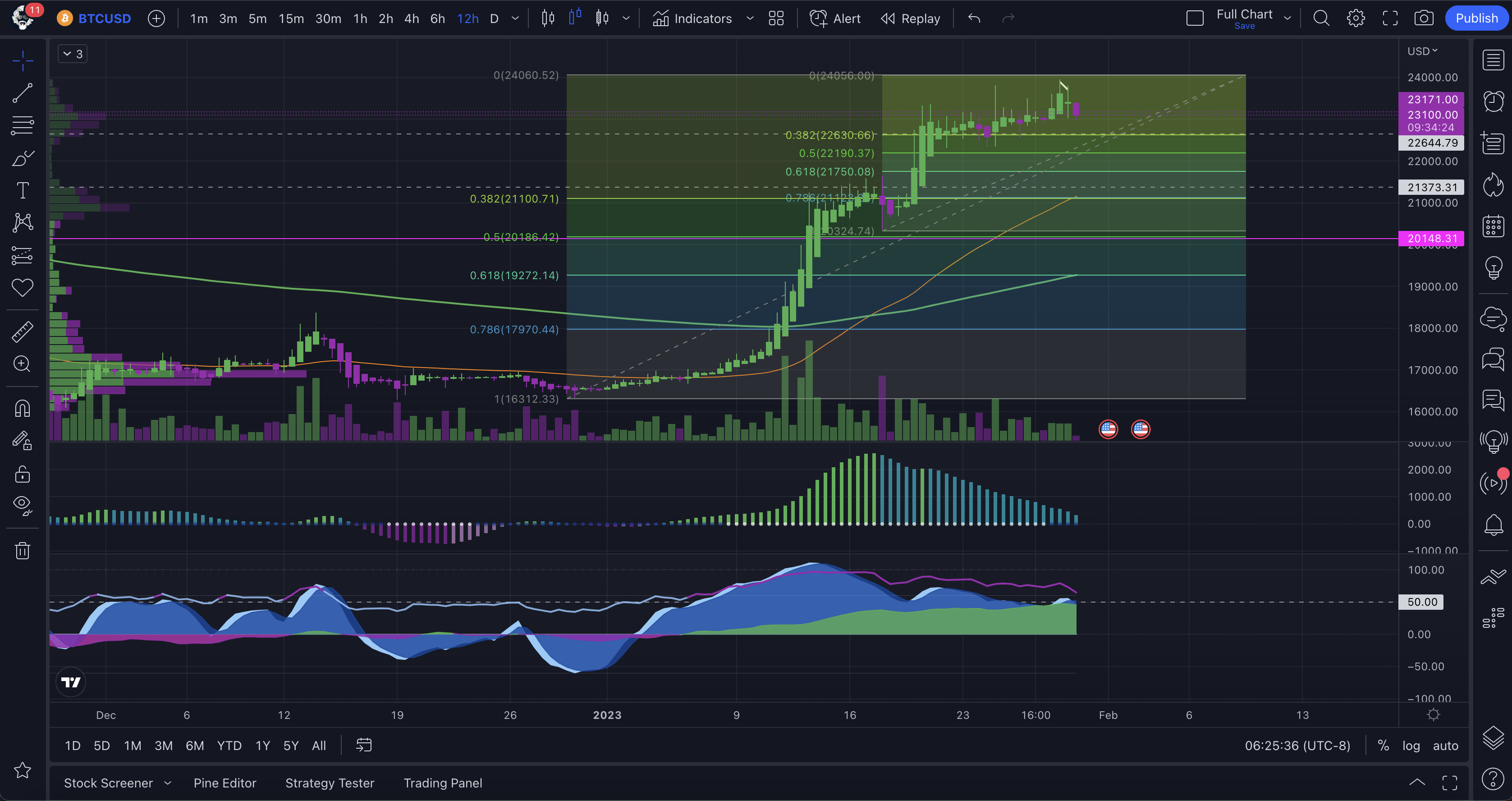

Starting with a zoomed out view

Starting with looking at the 12 hour time frame on Bitcoin, we can see that the 50 and the 200 EMA are still showing an uptrend that that the current price action that started overnight for me on the west coast of the US is showing a correction of the recent price rise.

Using the longer term time frames, you can get a real good view of support and resistance levels that Bitcoin’s price will have to contend with. This is where the Fibonacci tool comes in handy. In this case I pulled 2 measurement, one from the current micro swing low, and then one from the more macro swing low. This gives real good levels to watch for as far a points where the price of Bitcoin could come. What Bitcoin does when it gets to those levels is what we are watching for.

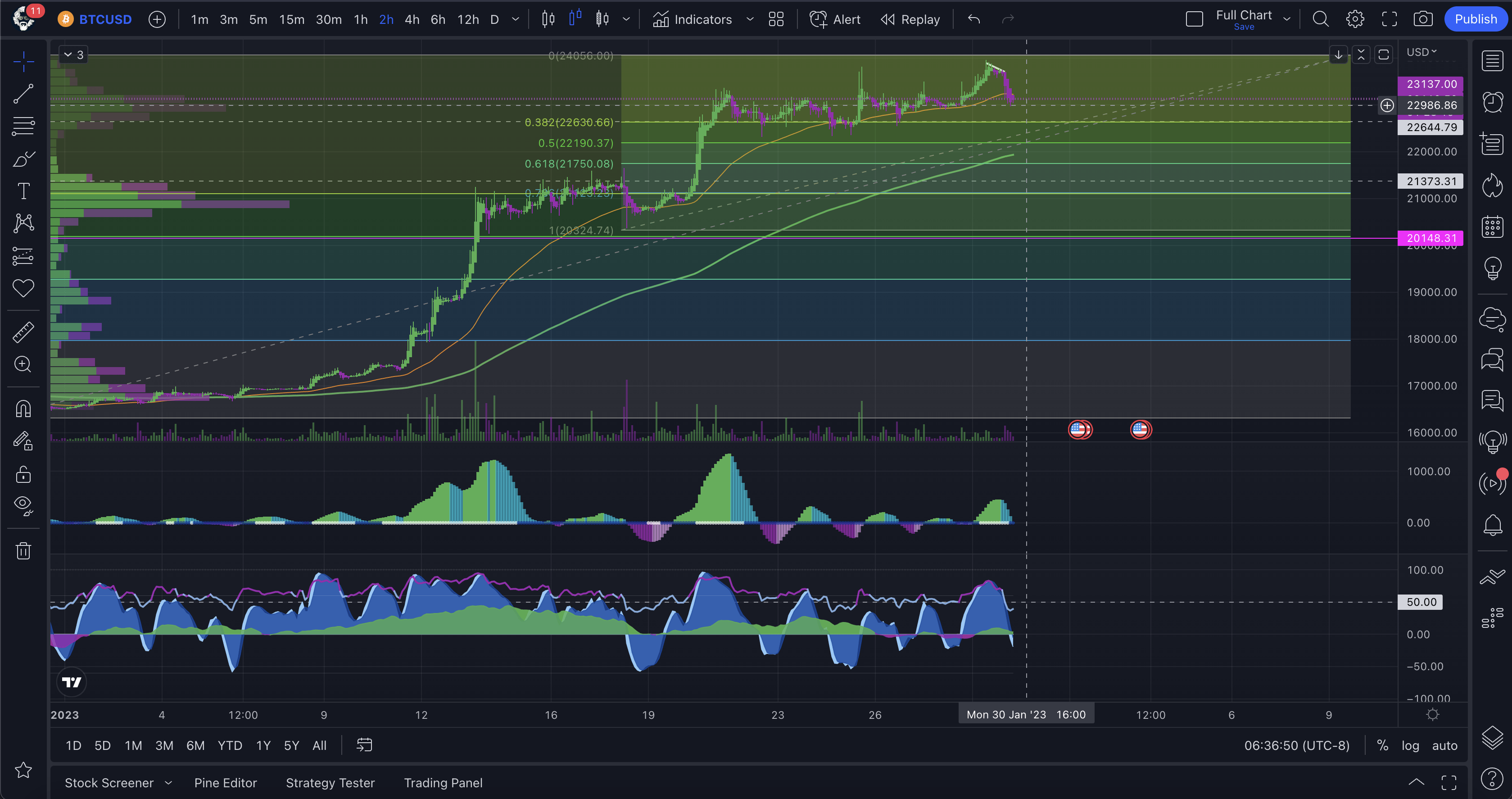

Zooming in a little closer

On the Bitcoin 2 hour time frame, we are seeing that the price has broken below the 50 EMA, although just slightly. The closer the 2 moving averages get to each other, with downward momentum, the more consolidation we are likely to see before heading any lower. That is to say that we will move any lower, although I would like to see the price correct back down a bit before moving on to higher levels. This will create better and stronger market structure in the long run. All we can do is take the data as it comes.

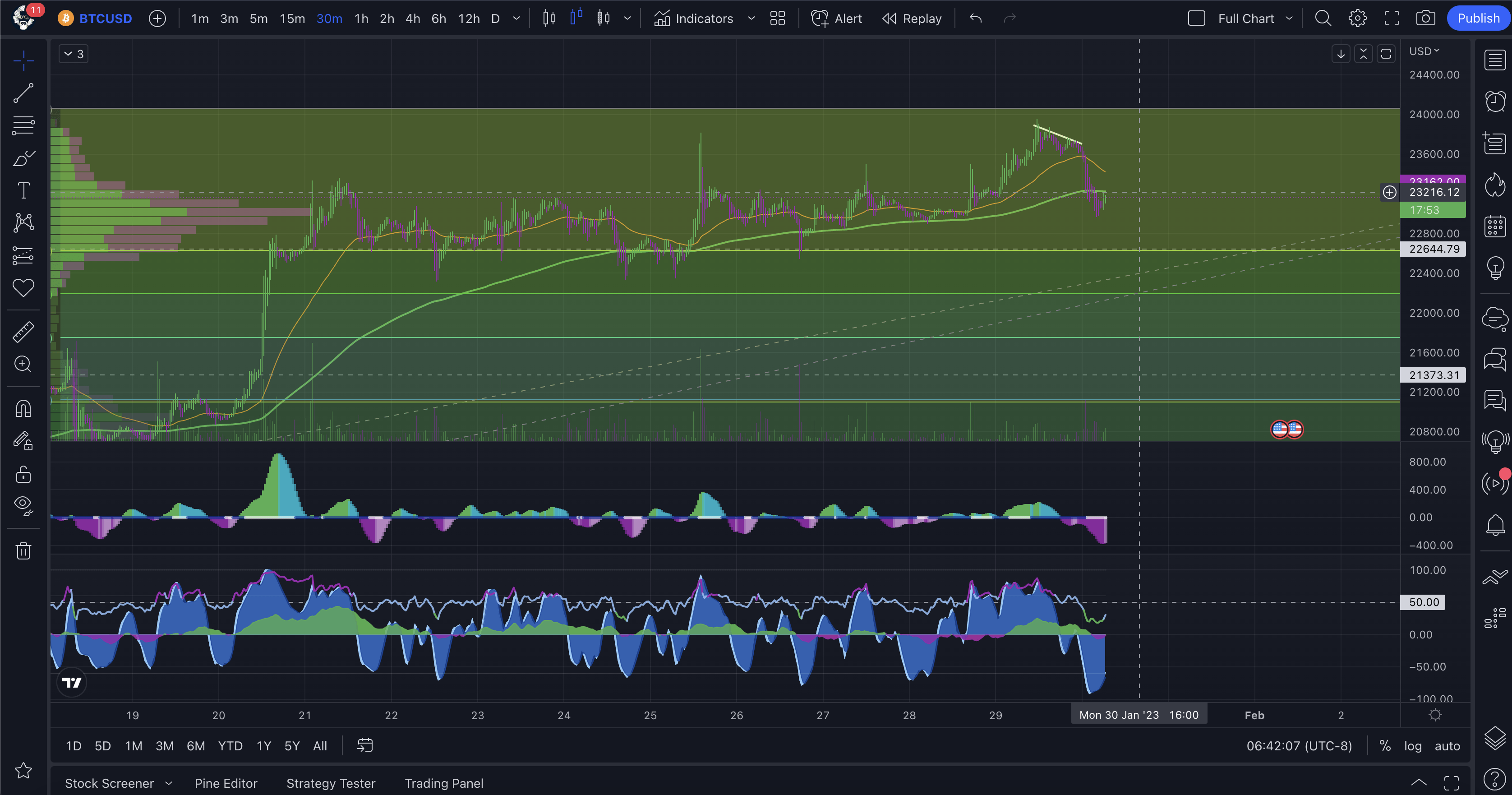

Getting down to the short term

On the 30 minute time frame, we are getting a better idea of what the price of Bitcoin is doing on this fine Monday morning. We had a bit of an overnight drop in price, which I was trying to stay up and wait on, but I fell asleep before the levels I was watching could break to the downside like I was planning on. Should have set a limit order, stop loss and take profit then gone to sleep, but yeah, the overload of coffee from the day went the other way so I crashed right before the price of Bitcoin did, haha.

What I am watching for is a retest of the 200 EMA and a move back to the downside and then I am in short city all day. My rule is do not short in an uptrend, which technically, based on longer time frames we are still in, so that is why you have to play shorts real tight until the trend fully confirms, because you could go short the the price rocket the other way on a bounce.

In this case I am being cautious because the Squeeze indicator and Market Cipher B are both in oversold conditions. I am waiting for a move to the upside to see if it retests and moves down, or if it breaks back through the moving averages and fakes everyone out.

Wrapping it up

So to wrap things up this fine and cold Monday morning, we are looking at a possible change in trend this week. That could include going from the step-up uptrend we have been seeing over the last couple of weeks to consolidation or into a full retracement. You never know in these volatile markets. The best idea is to set up some alerts on Tradingview for when the price reaches certain levels or when your favorite indicator makes a move. That lets you know when it’s time to start paying attention so you can go about your day and not have to stare at the charts.

If you are new to trading, try out Tradingview’s free account, but I highly suggest stepping it up to the pro or premium versions because you get so much more plus you don’t have to deal with annoying ads!

Be safe out there everyone in these crazy markets and have a great week!

Nothing said is financial advice.

This is for educational and recreational purposes only!

Stay safe in these volatile markets and don’t get rekt!

Follow the markets and get the latest data and news on Coin Logic

Any videos will be posted to Coin Logic TV on YouTube in addition to 3Speak:

https://www.youtube.com/coinlogictv

Upgrade to a paid Tradingview account and get more charts, indicators, screens and more!

Trade stocks, options, and cryptocurrency with us on Robinhood and pay no commissions! Use our link to sign up, link your account, and get a free stock!

Trade with us on Apollo X on BSC if you want to trade crypto with leverage in a decentralized fashion!