The Bearish Bitcoin Case- Weekly Chart Not So Bullish

Although the market sentiment lately is bullish for Bitcoin, something in my gut, or really in the charts tells me to slow my role. Actually, I have been calling for a correction back to near $20,000 Bitcoin for a while, but the markets are just being a bit stubborn, or I am just not patient enough (totally could be the case too). I figured out though, that I was just looking too short term. So let me explain the bearish Bitcoin case and how when we zoom out, the charts are not so bullish.

Too many people in the cryptocurrency industry are impatient and most traders look on the very short term time frames, and forget to zoom out. One reason is that many of the altcoins out there haven’t been around long enough to even register anything worth looking at on a weekly time frame. But with Bitcoin, we have plenty of history at this point. Let’s dive into the weekly chart and see what I am talking about.

Let’s Go Macro

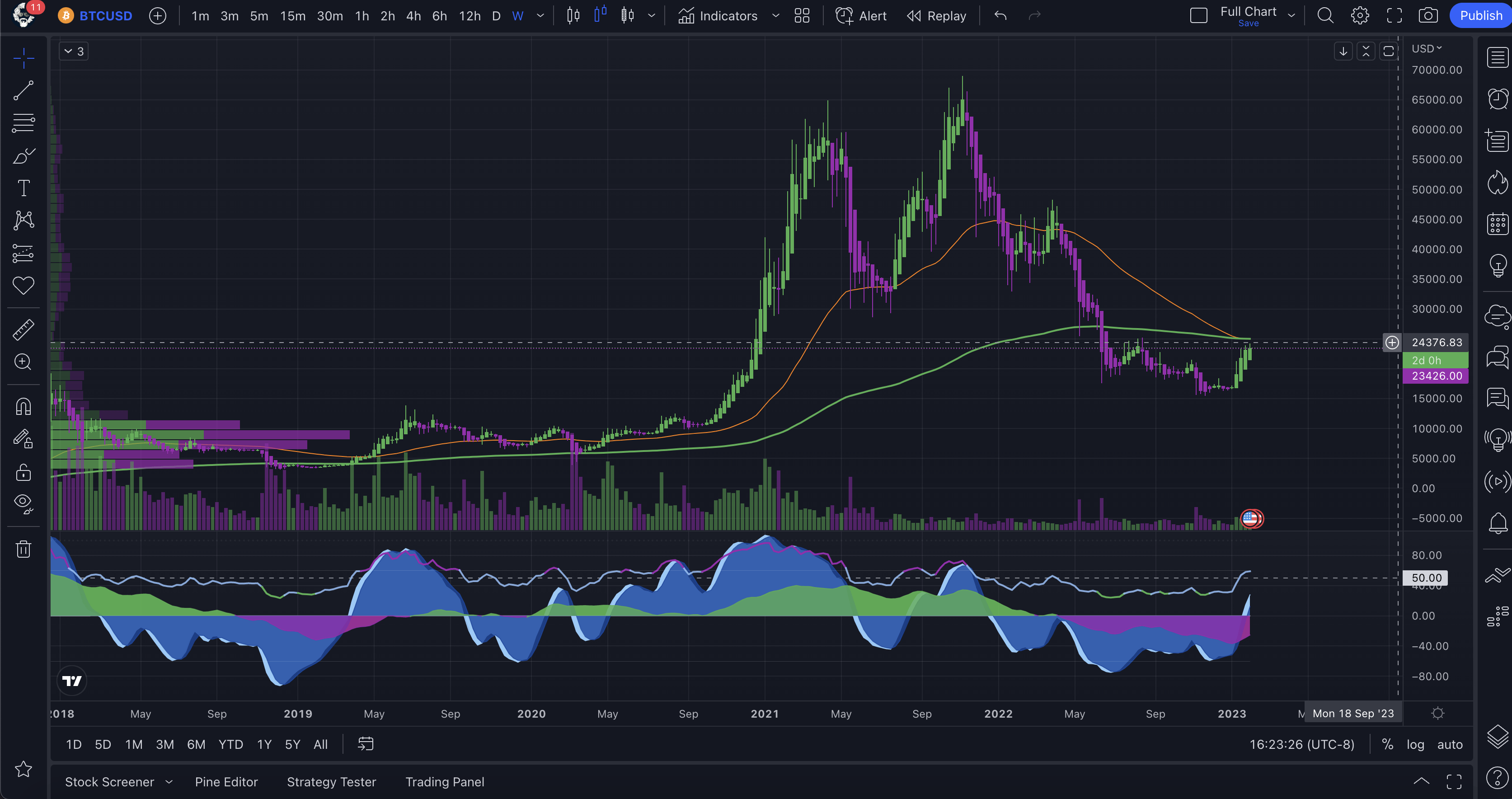

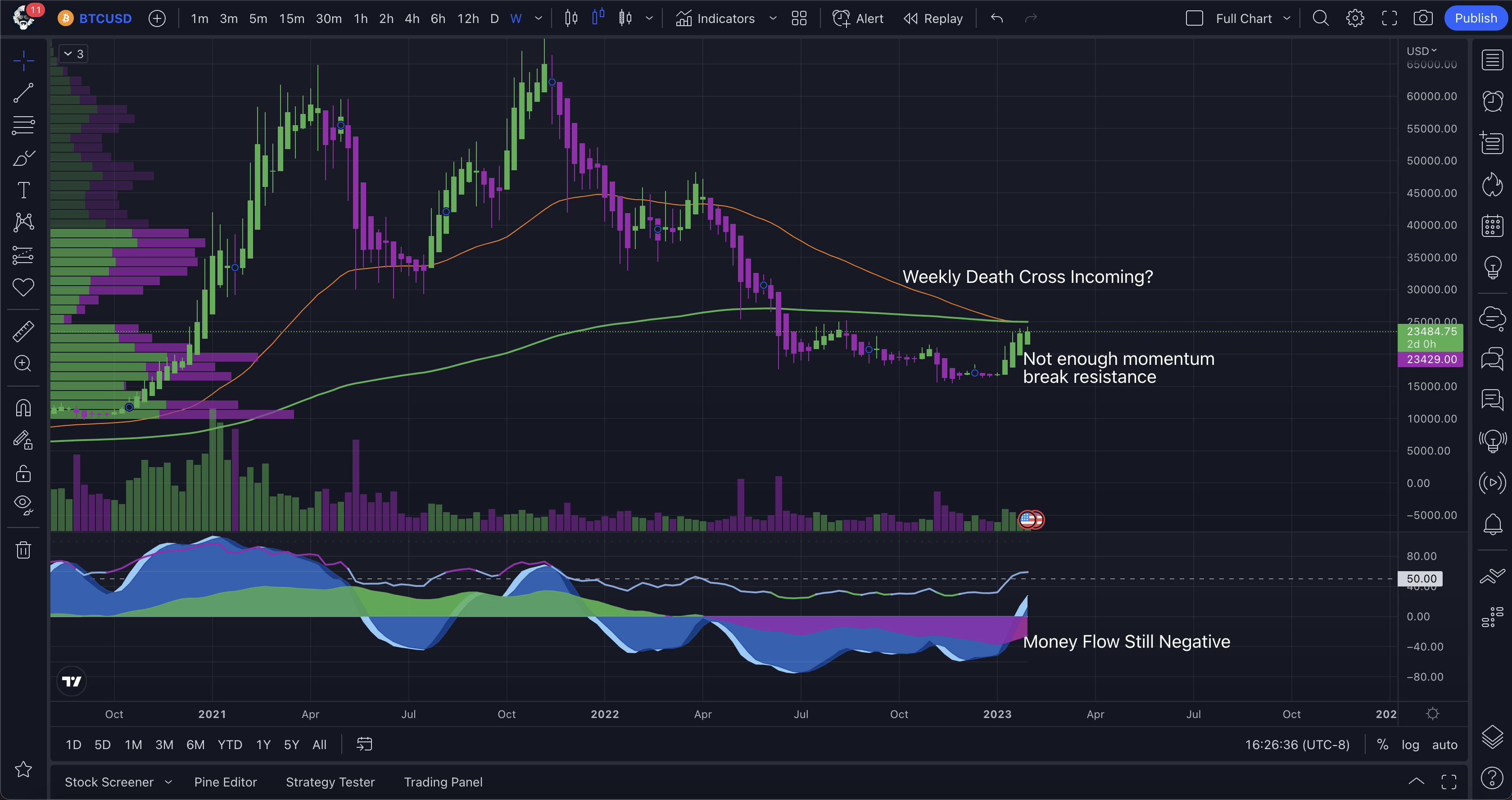

You have to zoom out to get the real story on what is happening. Longer the time period, the more data that is shown. On the chart above, we can see that the 50 period moving average is getting ready to make a cross below the 200 period moving average… This is not good for the Bitcoin bulls and would confirm what many traders (including myself) have been calling a ‘bull trap’ for this entire market pump.

Not only do we have the convergence of the two major moving averages, but we also seem to be topping out and do not have enough momentum to get back above the 200 week moving average, which the price has been below since July. When looking at it from this angle, this entire pump is merely a retest of the 200 EMA and we are getting ready to see either some consolidation, or a big move to the downside.

Money Flow Index In The Negative

Taking a look at the Market Cipher indicator and you will see the purple wave that is below the 0 line. This is the Money Flow Indicator and shows the flow of money in and out of the markets. Although the direction is starting to move up, that doesn’t mean we still can’t see further downside. In fact the wave is still real negative so, it would take a mighty push to get it back to the positive side. Just saying it may take a while.

Momentum and RSI are Looking Toppish

When you look at the momentum waves and the RSI on the Market Cipher indicator, you will see things starting to top out and turn, this means that the momentum is slowing down and that we could see some short term consolidation and a possible move to the downside. Don’t shoot the messenger, I am just showing you what I see in the charts.

Could We See Bitcoin’s First True Bear Market?

Now I want to be wearing my moon boots along with the rest of the bulls, but I don’t think that this current short term uptrend is going to sustain. There are going to be a lot of bulls trapped when or if this thing turns around. We could make have a rally up to 25K before this happens, that is totally in the cards, but we will fill that 20K CME gap, it is an inevitability. Let’s just hope it bounces there and we keep moving to the upside and actually trap some bears. If not, we could see the first true macro downtrend ever for Bitcoin and the cryptocurrency markets.

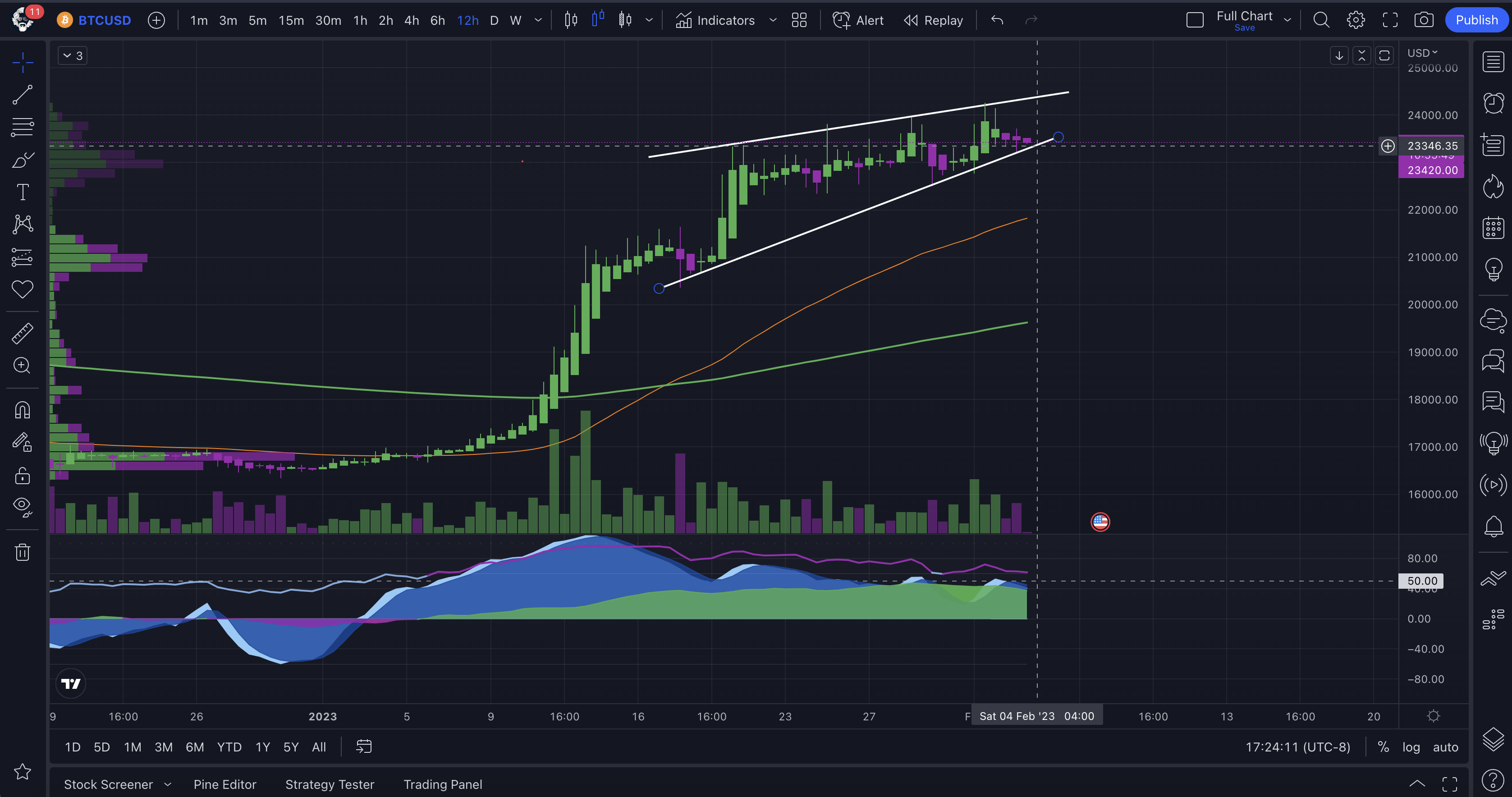

But I just want to be realistic and say that we could absolutely still see a down turn and a trip back to the lower levels and even getting that 10K number that many of the bears are talking about. Even on the shorter term time frames, we are seeing a rising wedge confirm. These patterns break to the downside approximately 80% of the time. I don’t think we have enough bullish momentum to take it the other way.

20K Price Range Needs To Hold

At that point, if we don’t consolidate, then 20K needs to hold or we may see some significant downside and see Bitcoin’s first true bear market as it would fail to regain the 200 MA for the first time, ever. So maybe the previous ‘bear markets’ for crypto were really just larger corrections and we are really now seeing the first true bear market for the cryptocurrency industry.

What do you think? Let me know in the comments if you have a Hive account! There you have it, the bearish Bitcoin case.

Are you bullish or bearish?

Stay safe trading out there everyone!

Nothing said is financial advice.

This is for educational and recreational purposes only!

Stay safe in these volatile markets and don’t get rekt!

Follow the markets and get the latest data and news on Coin Logic

Any videos will be posted to Coin Logic TV on YouTube in addition to 3Speak:

https://www.youtube.com/coinlogictv

Upgrade to a paid Tradingview account and get more charts, indicators, screens and more!

Trade stocks, options, and cryptocurrency with us on Robinhood and pay no commissions! Use our link to sign up, link your account, and get a free stock!

Trade with us on Apollo X on BSC if you want to trade crypto with leverage in a decentralized fashion!