How To Trade In A Downtrend

For many traders, one of the more difficult things to do is to figure out how to make money in a downtrend. What you have to do is figure out how to profit while the price is going down. There are a few different ways this can be done, and we’ll highlight a few of the ways we use to earn when the markets are not doing so hot.

Sitting In Cash

There is a saying in the trading world that no position is sometimes the best position to be in. There is no shame in sitting on the sidelines in the trading world. You may miss a little move here or there, but at least you don’t lose money.

Many traders who are starting out mainly focus on long-only trades. This is when you only buy assets in hopes that the price goes up and then sell when it gets to a target price you want to sell at. This is the best way to start out trading honestly as our next method can get a bit tricky.

Long Trading on Short Term Recorrections

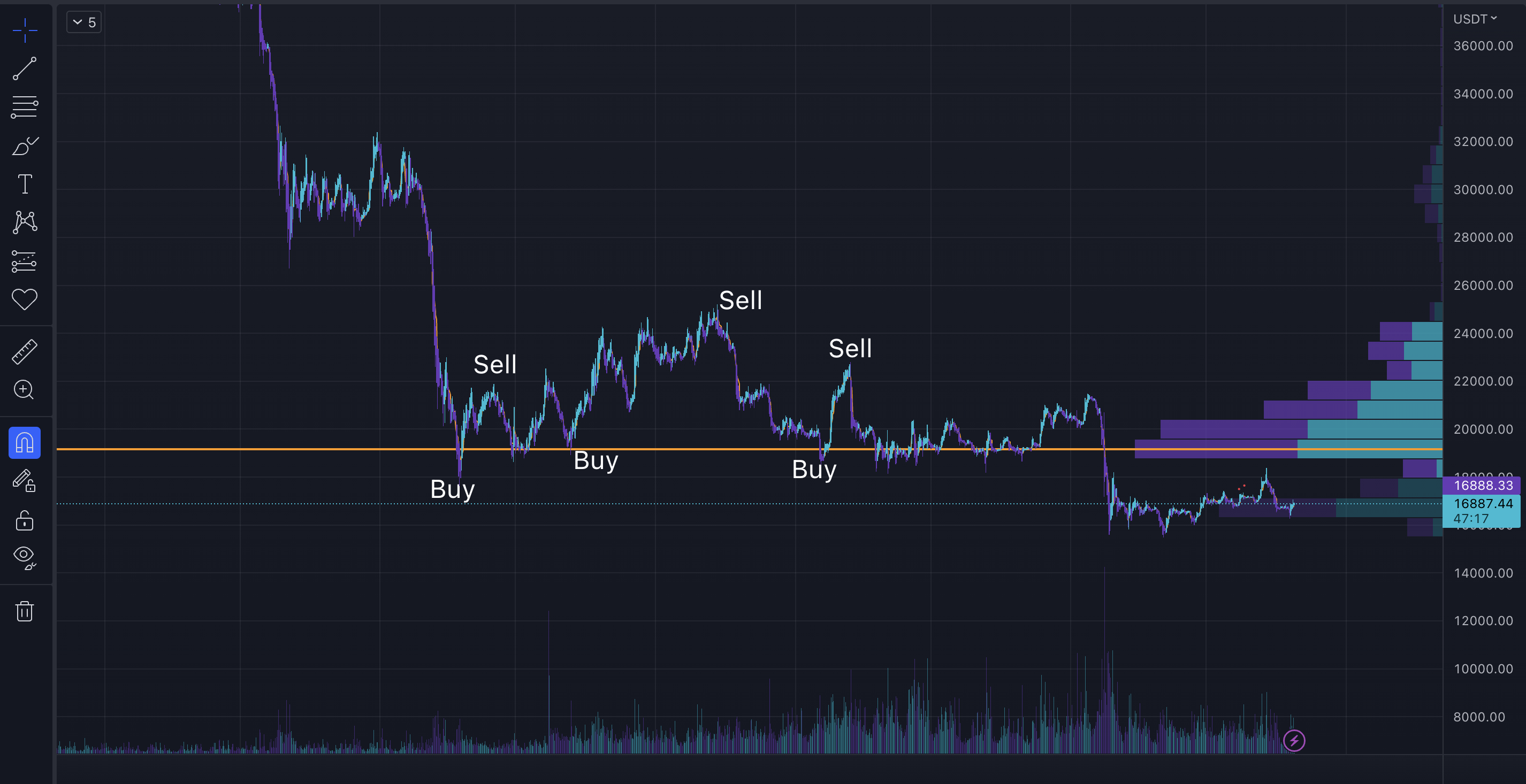

This is for those traders that only want to focus on long trades and don’t necessarily want to get into short trading. There are short-term opportunities to buy low and sell higher in a downtrend, so finding these short-term corrections can be a great way to make some money in a downtrend. Finding these corrections can be a bit tricky and can often lead to ‘catching a falling knife’ so you have to make sure you are paying attention and taking profits instead of riding the wave down.

Short Trading

Futures Trading

Trading an asset to the short side means that you are selling an asset at a higher price and buying back at a lower price, most of the time using margin or leverage trading. In the crypto markets this is mainly done using futures contract trading. This is when you select an amount of leverage you want to use and the asset you are wanting to trade. Let’s take BTC/USDT for example, as this is our main trade.

We usually sit in USDT and when we want to short the market, what is happening is that the exchange loans the amount of BTC you are using for the trade and holds your USDT in exchange. Then when the trade is done, you get the difference between the opening sell price and the closing buy price of BTC as your profit. In crypto and FOREX, this is done using ‘Futures’ exchanges, basically meaning you are betting on the future price of the asset.

You can trade futures on Bitcoin, Ethereum, BNB, ADA, and other top cryptocurrencies using a decentralized exchange on BSC called ApolloX. That is our current exchange of choice because it works on smart contracts where you always have control over your assets unlike a centralized exchange.

Put Options

In the stock market, to short a stock, you will have to trade what are called options. This is when you buy a contract that gives you control over 100 shares of a stock, for a fraction of the spot price. Think of it as the equivalent of flipping a house before closing.

When you are betting on a stock to go down, you are going to want to purchase a PUT option which is when you are betting on the price to be below your ‘strike’ price at the time of the option closing.

You can trade options with us on our stock brokerage of choice, Robinhood. We trade here because we can trade options, as well as spot trade cryptocurrency, and invest in dividend paying stocks all at the same time.

Stablecoin Yield Farming

Yield farming is a form of DEFI that lets users provide assets on both sides of the trade in exchange for a percentage of the trading fee. In many DEFI exchanges like Pancakeswap, which is where most of our yield farming happens, they also offer additional token rewards in a specific token, most likely an exchange token. In the case of Pancakeswap, you earn the CAKE token, that can then be exchanged for any other asset on Binance Smart Chain, or used to add more funds to your yield farms and compound your gains.

You will have a more secure and stable investment if you are providing liquidity to stablecoin-paired markets. Some yield farming platforms like Cubdefi.com also offer stablecoin pairs like USDC/bHBD, so that both sides are actually stable and you are farming a nice yield of their CUB token.

Hive Backed Dollar Savings

The Hive Backed Dollar, or HBD, is the algorithmic stablecoin on the Hive blockchain. There is no issuer other than the blockchain protocol, which makes it arguably the most decentralized stablecoin in the industry. The beauty of the Hive blockchain is that you get paid in both the Hive and HBD tokens when you make a post, upvote, or comment. You can then put the HBD token into your savings wallet where it will earn 20% APR currently. So getting active in the community is a great way to stack stablecoins and earn passive income in a downtrend.

These are just some of the ways that people can earn money in a down market. Of course, this is just here to give you some tips based on our experience and what we do here at the Coin Logic trading desk. Make sure you are always doing your own research and never invest more than you can afford to lose.

Nothing said is financial advice.

This is for educational and recreational purposes only!

Stay safe in these volatile markets and don’t get rekt!

Follow the markets and get the latest data and news on Coin Logic

Any videos will be posted to Coin Logic TV on YouTube in addition to 3Speak:

https://www.youtube.com/coinlogictv

Trade with me on Apollo X on BSC