Top 5 List Of My Favorite Decentralized Exchanges And Lending Platforms

With the fallout of FTX, the second largest centralized exchange, or CEX, in the world behind Binance, it is extremely important to remember the original ethos of cryptocurrency anyway, NOT YOUR KEYS, NOT YOUR COINS! When you send your money to a centralized exchange, you are giving up control of your funds, in hopes the unregulated entity that you are sending your money to is going to not rob you, or do things like use your funds to leverage trade and lose it all, looking at you FTX and Alameda!

So what are people to do if they want to trade, but not lose control over their coins? Well, there are these new platforms called decentralized exchanges or DEXs! These exchanges are essentially just smart contracts, or a series of smart contracts on a blockchain in which users are the providers of market liquidity and swaps are handled by the blockchain. You never lose control of your funds!

Same with centralized lending platforms. We see that companies like Celsius, Voyager, BlockFI, and now Gemini’s Lending arm, Genesis, are all becoming insolvent. That is because they are ran by greedy humans and not code. There are also decentralized lending platforms that you can use to earn yield on your coins without losing control!

Let’s take a look at some of my favorite decentralized trading and lending platforms!

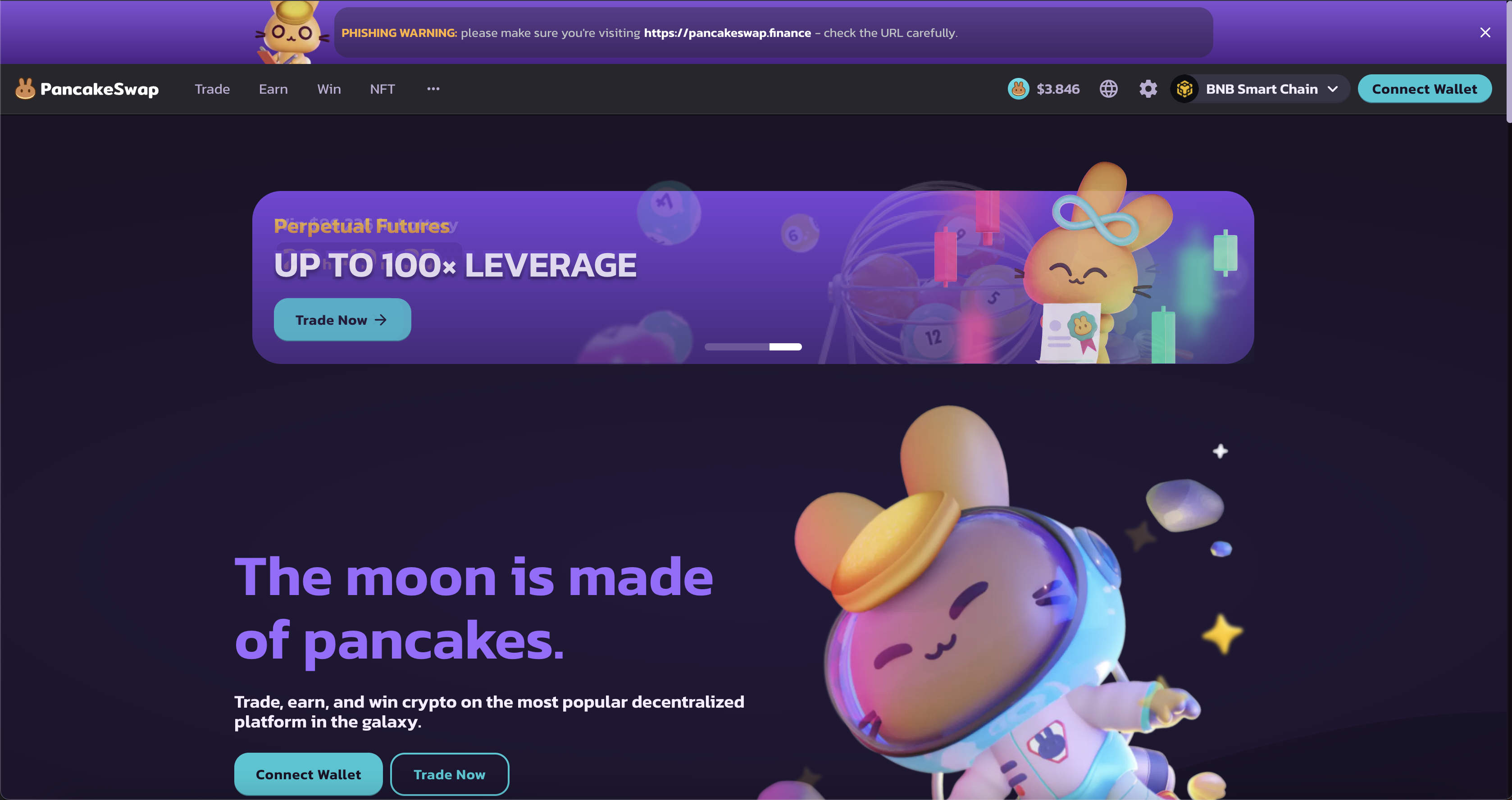

PancakeSwap.Finance

The first DEX on my list is PancakeSwap on Binance Smart Chain (BSC) and now also trading on Ethereum and Aptos (which I know absolutely nothing about, haha).

Pancakeswap was born in the DEFI craze of 2020/2021 when there were countless ‘food name’ DEFI applications popping up. Pancakeswap has been the one platform that has stood the test of time, mainly because it was the platform everyone else was trying to fork from.

They are originally a fork of Uniswap on Ethereum (which is not on the list because it is on Ethereum). They launched on Binance Smart Chain to give users another option besides having to pay the insane gas fees on Ethereum.

Over time Pancakeswap has expanded and matured and now is one of the largest DEXs based on liquidity in the world.

Not only can you swap tokens, set limit orders, and provide liquidity and farm CAKE tokens, but they have also now partnered with the ApolloX exchange protocol and have their own Perpetual Futures trading platform! I have been using it to trade and love it, just need a bit more liquidity in my opinion. But with people needing to find alternatives for leverage trading vs FTX, this is a great decentralized option!

NOTE: US residents need to use a VPN to trade on ApolloX and Pancakeswap’s Perpetual trading platform.

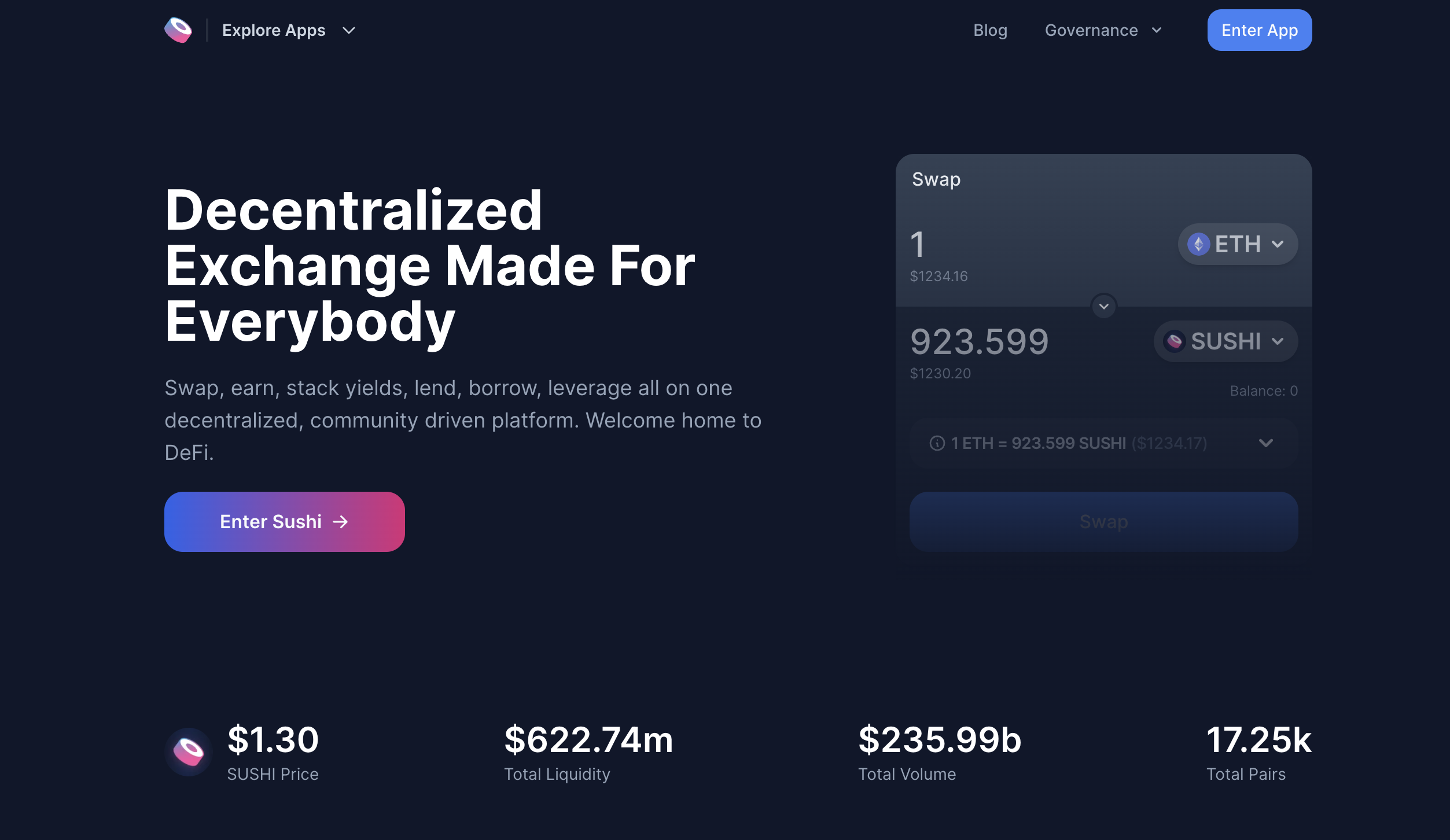

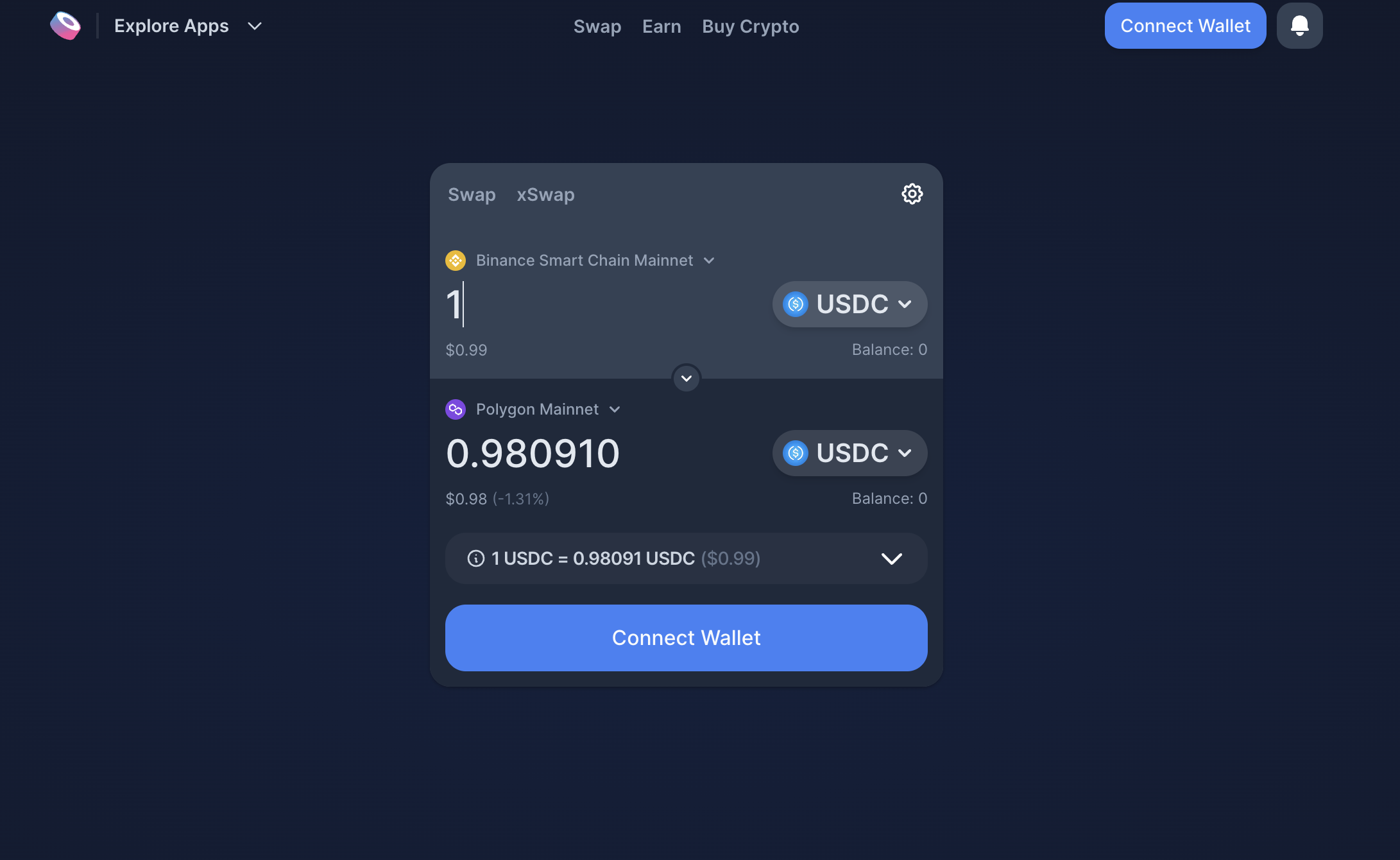

Sushi Swap

Sushi Swap is another food name platform that popped up in the DEFI summer of love in 2021. Sushi has expanded support to several EVM based blockchains which has pushed it to the top of the DEX list. There are many options to swap, set limit orders, and earn yield through liquidity providing as well!

One thing for me that sets Sushi apart from other platforms is the ability to cross-chain swap. This allows users to exchange tokens from one chain to the other, for example from BSC to Polygon. It can also be used as a bridge in the same way. For example, you want to move USDC from BSC to Polygon, a simple xSwap on Sushi makes it happen for a fraction of the cost of other bridges.

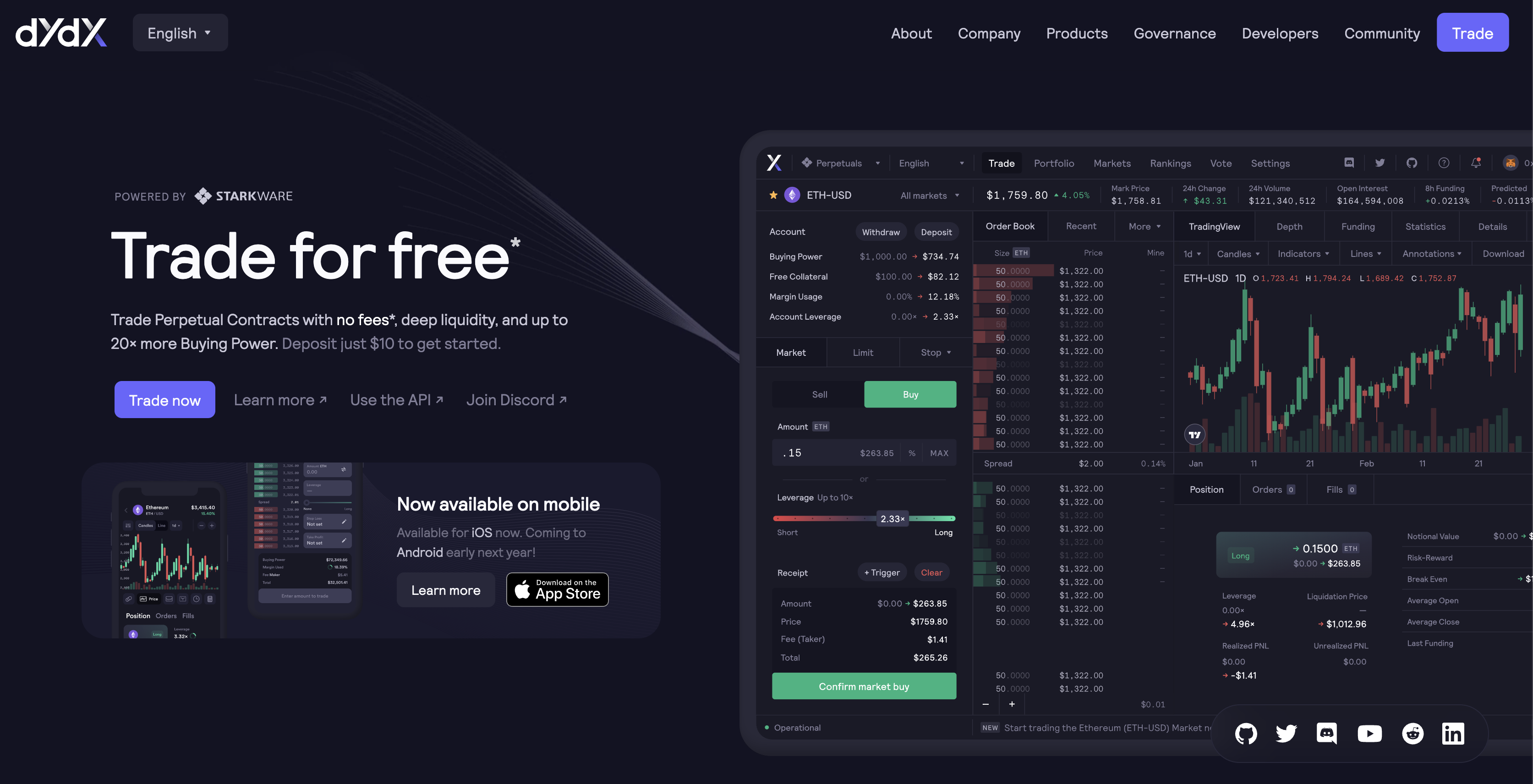

DYDX

DYDX is one of the first, if not the first, decentralized, smart contract based leverage trading platforms. It is currently running on Ethereum, but they are working on moving to their own Cosmos SDK based IBC blockchain.

In the meantime, they have moved their trading functionality to a second layer, so that the only Ethereum gas fees you pay are when you deposit and withdraw from the platform, same as with Pancakeswap’s leverage trading platform and ApolloX. This let’s you only be responsible for the exchange fees and not extra gas on every trade, creating a better profit margin for your trades!

NOTE: US residents need to use a VPN to trade on DYDX

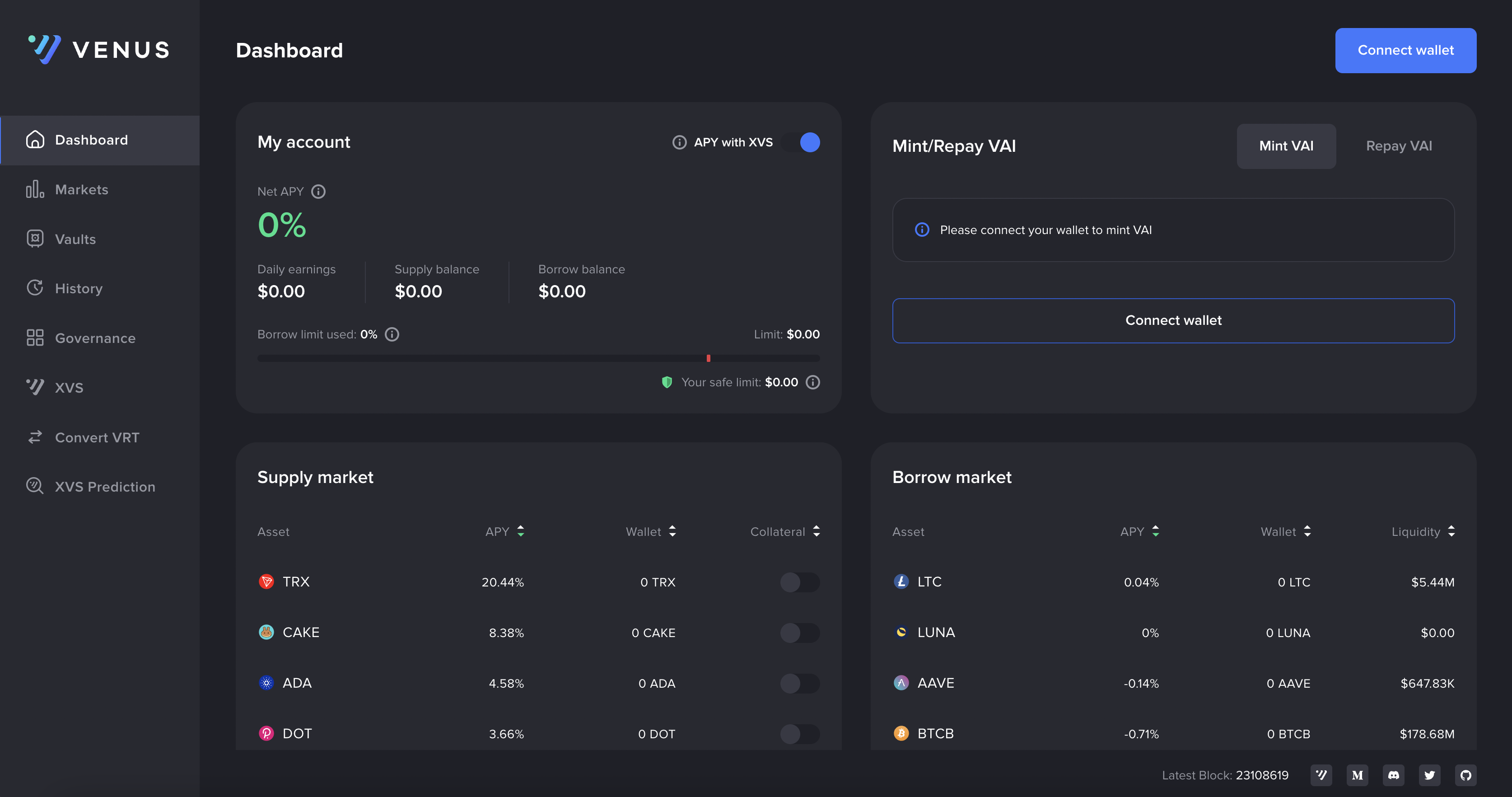

Venus Protocol

Moving along from exchanges, the Venus Protocol on Binance Smart Chain is an awesome decentralized lending and borrowing platform. They give you a large number of options for assets to supply as collateral and borrow.

Due to the sheer amount of assets available to use on this platform, is why it is, in my opinion, the best platform for lending and borrowing. Other comparable platforms really can’t hold a candle to Venus in this regard and are extremely limited in their offerings.

I use Venus as a bank account/credit line. I supply assets to the protocol and because they are being supplied to the lending markets, I am earning interest for my assets sitting in the platform. When you deposit an asset, you are given a Venus token that represents your deposit. So if you deposit USDC, you will get vUSDC back. When you remove your supply, you end up with more USDC than you put in.

Once you have supplied assets, you will be able to use it as collateral to borrow other assets. I use this to borrow stablecoins and pay bills, then pay back the loan with other earnings. You can also use this as a leverage account of sorts for trading. For example, you want to manually short MATIC, you supply USDC, borrow MATIC and then sell it for USDC, once the price of MATIC drops, you then buy back at a lower price, pay back the loan then you have additional MATIC left over that I ride the bounce back up, sell into USDC, and then I have more USDC for my trading account.

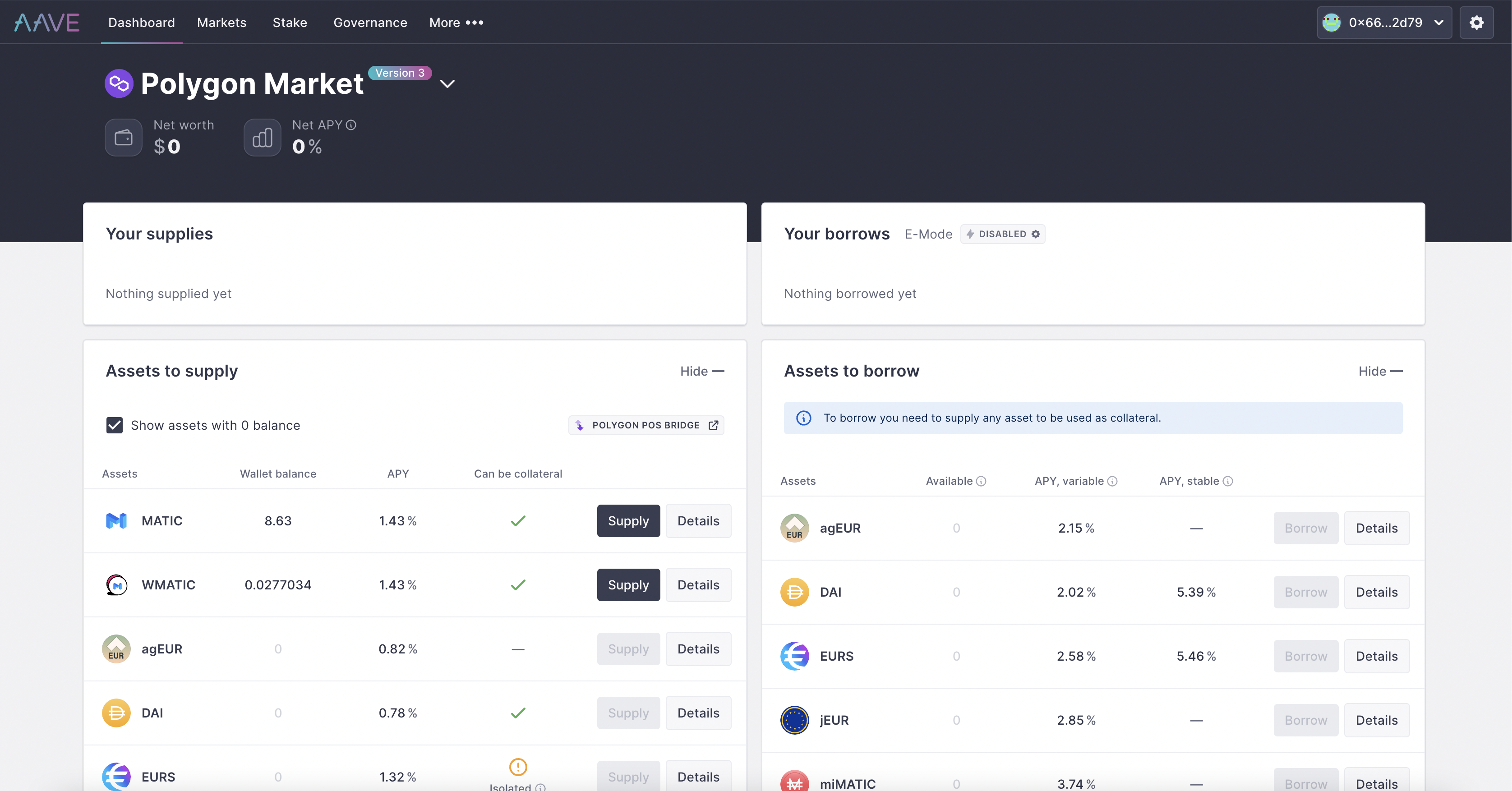

Aave

Aave is very similar to Venus and operates the same way. These are both spawns of Compound Finance that was the original lending/borrowing protocol on Ethereum.

Aave has moved off to accept other EVM blockchains. It is the lending/borrowing platform of choice for Polygon and Avalanche for sure. It works the same way that Venus does. You supply collateral, earn interest, and borrow against your collateral. Same as Venus, when you deposit tokens, you get the Aave version to hold for as long as you are using the protocol.

Always Do Your Own Research

These are the main platforms I use these days for various reasons. Of course there are other options out there and I can’t end this without mentioning Tribaldex and BeeSwap on Hive, but I don’t do any real trading there due to lack of liquidity for the tribe and community tokens.

No matter what platform you use, make sure you are doing your own research on that platform. Read about the apps, go through the docs, and learn how it works. Who knows, you might be shocked at what you learn!

And always remember to abide by this one rule…

NOT YOUR KEYS, NOT YOUR COINS!

Until next time everyone…

Be Cool, Be Real, and always Abide!

Nothing said is financial advice.

This is for educational and recreational purposes only!

Stay safe in these volatile markets and don’t get rekt!

Follow the markets and get the latest data and news on Coin Logic

Any videos will be posted to Coin Logic TV on YouTube in addition to 3Speak:

https://www.youtube.com/coinlogictv

Trade with me on Apollo X on BSC

Read on LeoFinance Beta on the Hive Blockchain